Introduction: Brazil is a market of 210 million people

Brazil is the largest country in South America, and with a population of around 210 million people, is a huge market to consider when launching a drug. However, as a country with significant organisational and budget constraints, not to mention massive wealth inequities, it can be a difficult market to navigate. In this article, we will break down the basics of launching a drug in Brazil, looking at five key things you need to know.

1. Consider the public and private markets

Universal healthcare coverage is a concept that Brazil aims for within its healthcare system, with some level of public health provision dating back to the 1920s.1 The Unified Health System (SUS, Sistema Único de Saúde) has been in place since the 1980s and provides public health care to the Brazilian population.2 Among other services, the SUS formulary, Relação Nacional de Medicamentos Essenciais (RENAME) consists of a list of essential medications that are available free of charge.3

However, the private market in Brazil is substantial, with 25% of the population relying instead on private insurance. Private health insurance is often accessed as an employment benefit, although individual private plans are also utilised. As well as insurance coverage, the private market also consists of out-of-pocket payments for certain medications.4

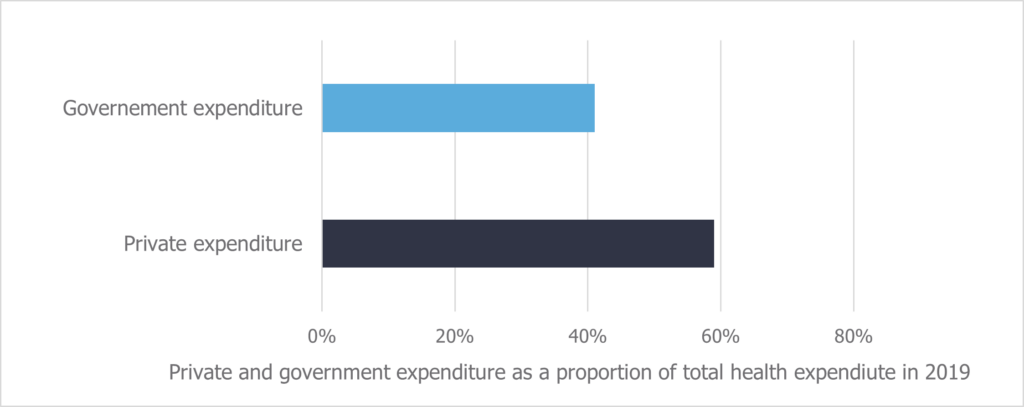

This creates deep inequities to healthcare and medication access in Brazil. More medicines are available through the private market, which is limited to the wealthier and more stably employed population. In fact, total spending is greater in the private market than the level of government spending on healthcare, despite only 25% of Brazilians being insured (Figure 1- typo in the “governement expenditure” label).4,5 Further to this, where medicines are not included on RENAME, those citizens without access to private insurance are forced to choose between paying out-of-pocket or going without. Out-of-pocket payments account for over 27% of total health expenditure in Brazil, and disproportionately affect poorer households, on which they can be a significant burden.4

2. Maximum drug price is set by the CMED

Whether a drug will be accessed primarily through the private or public market, the first step is approval from the Health Regulatory Agency (ANVISA, Agência Nacional de Vigilância Sanitária of Brazil). Following ANVISA approval, the maximum price is set at the national level. This is also a step that must be done regardless of private or public intentions. The Drug Market Regulation Chamber (CMED, Câmara de Regulação do Mercado de Medicamentos) is the key stakeholder here.

CMED sets the price by sorting a drug into one of six price categories, based on level of innovation. Category one is the ‘gold standard’, where drugs may be considered innovative based on proven additional benefit over an appropriate comparator. Drugs in category one get the most generous pricing mechanism, with greater restrictions placed on each subsequent category, two through six.

Once the maximum price is set, the next step is the decision to fund. The Federal Regulatory Agency for Private Health Insurance and Plans (ANS, Agência Nacional de Saúde Suplementar) will decide if it should be included in the list of minimum procedures and services private insurance must provide. For public funding, and inclusion on the SUS formulary, the drug is subject to health technology assessment (HTA).

3. CONITEC carries out HTA appraisals

The National Commission of Technologic Incorporation (CONITEC, Comissão Nacional de Incorporação de Tecnologias) was established in 2012.4 It is responsible for carrying out HTA evaluations for the reimbursement decisions of new drugs and is supported by the Brazilian Network for Health Technology Assessment, who conduct the appraisals. CONITEC then make inclusion/exclusion recommendations to the Ministry of Health. The decisions are based upon safety and efficacy data versus an appropriate comparator, as well as economic and budget impact analyses. The use of real-world data in CONITEC submissions is also gaining traction.

4. Further decisions could be made at a regional level

If a drug is excluded from the SUS formulary, some regional governments may choose to fund it at a local level. Certain states, such as São Paulo and Rio de Janeiro, have lists of exceptional medicines they fund in addition to the SUS formulary.

However, regional coverage is massively varied, partly due to the vast wealth disparity between richer and poorer states. Further exacerbating this, richer states also have greater number of citizens covered by private insurance, thus less reliant on publicly funded medicines; 48% of people in São Paulo (GDP per capital R$44K) have private medical insurance, compared to just 25% in Maranhão (GDP per capita R$11K).6

5. Patient access to high-cost drugs is a contentious issue

Despite the drive to achieve universal health coverage in Brazil, it is a country hit hard by economic and political crises, which have led to stagnated government health expenditure2 and leaving SUS often unable to fund high-cost drugs. Access to such drugs is then only possible via private insurance or out-of-pocket payments, which as previously discussed places the greatest burden on the poorest households and drives regional inequity.

Increasingly, this is being combatted by judiciary reviews, where citizens take SUS to court to mandate the coverage of certain medications. This is not a sustainable solution, with $143 million distributed in claims in 2015 – an unwelcome strain on an already stretched budget.7 Nor is this new, the practice of “right-to-health” litigation existed before CONITEC’s conception, with the HTA body introduced with the hope of standardising coverage decisions. However, the number of medical-judiciary claims are in fact continuing to increase, with CONITEC appraisals rarely quoted in court decisions.8 As such, this remains another driver of access inequity in Brazil.

Conclusion

Brazil is both a large and complex market when it comes to market access. When launching, or considering launching, in Brazil you must consider both the public and private markets, how access may vary regionally, and all the key stakeholders involved. Given the huge disparity that remains in patient access, patients are often a stakeholder themselves. Patient ability and willingness to pay often needs to be considered alongside the drivers for the price and HTA bodies.

This article is only an introduction to the Brazilian market access landscape. To find out more about how we can support your market access training or launch needs in Brazil, or other emerging markets, do not hesitate to get in touch.

Sources:

- Medcalf A, Bhattacharya S, Momen H, et al., Health For All: The Journey of Universal Health Coverage. Chapter 14: Brazil: The Challenge of Universal Health Coverage. Hyderabad (IN): Orient Blackswan; 2015.

- Massuda A, Hone T, Gomese Leles FA, de Castro MC and Atun R. The Brazilian health system at crossroads: progress, crisis and resilience. 2018. BMJ Glob Health. 2018;3:e000829. doi:10.113. 3(4): e000829.

- Osorio-de-Castro CGS, Azeredo TB, Pepe VLE, Lopes LC, Yamauti S, Godman B and Gustafsson LL. Policy Change and the National Essential Medicines List Development Process in Brazil between 2000 and 2014: Has the Essential Medicine Concept been Abandoned? 2017. Basic & Clinical Pharmacology & Toxicology 122(4): 402-412.

- Massuda A, Andrade MV, Atun R and Castro MC. International Health Care System Profiles: Brazil. The Commonwealth Fund. 2020. Accessed 14/04/22. https://www.commonwealthfund.org/international-health-policy-center/countries/brazil

- World Bank. World Health Organization Global Health Expenditure database. The World Bank Data Bank. 2022. Accessed 14/04/22. https://data.worldbank.org/indicator/SH.XPD.GHED.CH.ZS?locations=BR

- Brazil Institute of Geography and Statistics. 2010. Accessed 14/04/22. https://www.ibge.gov.br/en/home-eng.html

- Troeger CE, Khalil IA, Blacker BF, Biel MH, Albertson SB, Zimsen SRM, et al. Quantifying risks and interventions that have affected the burden of lower respiratory infections among children younger than 5 years: an analysis for the Global Burden of Disease Study 2017. 2020. The Lancet. 20(1): 60-79.

- Wang D, Pires de Vasconcelos N, Poirier MJP, Chieffi A, Monaco C, Sritharan L, Rogers Van Katwyk and Hoffman SJ. Health technology assessment and judicial deference to priority-setting decisions in healthcare: Quasi-experimental analysis of right-to-health litigation in Brazil. 2020. Soc Sci Med. 265: 113401.