Introduction

As the most populous country in the world with 1.4 billion inhabitants, China has the potential to be an attractive market for pharmaceutical companies. Historically access to the market has not been transparent, but in recent years the process for achieving reimbursement at the national level through the National Reimbursement Drugs List (NRDL) has become more established. The value of the Chinese market is now second only to the US with an estimated value of 161 billion US dollars and rising1. Gaining access to the NRDL would therefore, appear to be a golden ticket for pharmaceutical companies’ sales. We take a closer look at the opportunities and challenges presented in China.

What is the NRDL?

There are three main routes to market in China: private healthcare, out-of-pocket/patient assistance schemes and public reimbursement.

Out-of-pocket/patient assistance schemes have typically been the first route taken by manufactures, and with a rising middle class this route presents a sizeable opportunity, accounting for approximately 30% of health care spending2. Inclusion on the NRDL means that products will be fully or partially reimbursed at a national level and in general are the only products to be prescribed from public hospitals. Historically drugs included on this list were mostly generics and favoured domestic manufacturers. However, the transformation of the NRDL since 2017 has been substantial; after 8 years of no updates, China agreed that as part of the Healthy China 2030 policy the NRDL would be updated annually (see this article about the 2021 updates). Since then, almost 300 drugs have been added to the NRDL and it now contains 1,486 ‘Western’-made medicines alongside 1,374 Chinese-patented medicines4. Additionally, the space is increasingly opening up to innovative products as a result of reforms to speed up the development and approval processes of these therapies, allowing the list to move away from being populated primarily with generics. Further reforms to make clinical trial requirements less restrictive are also anticipated, for example allowing companies to submit regulatory data from a more diverse group of patients whereas currently data must be collected from Chinese patients, further increasing the likelihood that a product might enter the NRDL6.

How do products get on the NRDL?

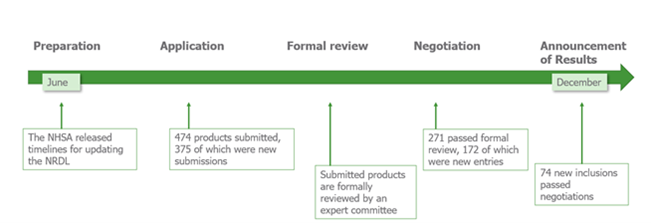

Prior to the reforms in 2020, manufacturers had to await selection for the NRDL; now manufacturers have the option to apply for NRDL inclusion. Experts in the disease areas as well as non-experts will carry out the selection process and review the clinical need, efficacy, safety, budget impact and cost-effectiveness. Manufactures have little time to prepare for NRDL inclusion with the applications opening just 6 months before negotiations for the short-listed products as displayed in the timeline below.

Benefits of being added to the NRDL

Many branded therapies have seen sales surges after NRDL inclusion, for example sales of Sanofi’s Fabrazyme and AstraZeneca’s Lokelma reported sales of greater than three times more in the year following NRDL inclusion compared with the previous year7-9. Additionally, as time to NRDL inclusion has been slashed manufacturers can reach patients in China sooner. There is also greater transparency of the process with some submission material being made public. Moreover, information is being provided on 10. Greater transparency will likely move the process to be more uniform and help manufacturers understand the key drivers for access to the list.

Drawbacks of being added to the NRDL

However, the increased opportunity for access to this large market has its share of drawbacks. The Chinese government has made strikingly high demands to lower the price of drugs; sometimes asking for discounts as high as 90%, though the average discount for new products in 2021 was 62%11. Manufacturers are now having to make the decision whether the patient volume in China justifies the price reductions. This can also have implications for prices in other countries as the prices in China are public. Furthermore, the negotiated price can be subject to further price reductions if, for example, alternative competitors become available. Price negotiations will occur every two years and can require large price cuts if a product wishes to stay listed.

Moreover, though innovative products are increasing their chances of being reimbursed, Chinese manufacturers are still being favoured for some products, exemplified by the lack of inclusion of foreign made PD-1/L1 inhibitors but the inclusion of three which were made domestically4. Furthermore, although manufacturers can submit the request to be included in the NRDL it does not mean that it will be added, and the companies must ensure relevant physicians are aware of their product.

Conclusion

As the main pathway to access to the Chinese market many companies may decide that the pricing compromises are necessary to access the NRDL and are likely to be advantageous given the huge patient population it provides access to. However, if manufacturers deem the price reductions on their products to access the NRDL to be too large, the out-of-pocket market is also significant in volume and avoids providing huge discounts on their products, which given Chinese prices are public, negates having to also reduce prices in other countries which may use China in their price reference group.

Sources:

- IQVIA. The Global Use of Medicine in 2019 and Outlook to 2023. 2019. https://www.iqvia.com/insights/the-iqvia-institute/reports/the-global-use-of-medicine-in-2019-and-outlook-to-2023

- Fu W, Zhao S, Zhang Y, Chai P, Goss J. Research in health policy making in China: out-of-pocket payments in Healthy China 2030. BMJ. 2018;360:k234. doi:10.1136/bmj.k234

- PharmExec. China 2021 National Reimbursement Drug List Outlook. Accessed 21st April, 2022. https://www.pharmexec.com/view/china-2021-national-reimbursement-drug-list-outlook

- National Medical Products Administration. NRDL, 2021. 2021. http://english.nmpa.gov.cn/

- Remap Consulting. Continuing the push for innovation: Key learnings following China’s most recent NRDL update. Accessed 21st April, 2022. https://remapconsulting.com/china-nrdl-update/

- Cambridge Healthcare Research. China Market Access: Opportunity or Obstacle? Accessed 21st April, 2022. https://camhcr.com/blog/china-market-access-opportunity-or-obstacle

- AstraZeneca. What science can do AstraZeneca Annual Report and Form 20-F Information 2021. 2022. https://www.astrazeneca.com/content/dam/az/Investor_Relations/annual-report-2021/pdf/AstraZeneca_AR_2021.pdf

- Sanofi. Form 20-F 2020. 2021. https://www.sanofi.com/-/media/Project/One-Sanofi-Web/Websites/Global/Sanofi-COM/Home/common/docs/investors/Form-20-F-2020—Sanofi.pdf

- Sanofi. Form 20-f 2019. 2020. https://www.sanofi.com/-/media/Project/One-Sanofi-Web/Websites/Global/Sanofi-COM/Home/common/docs/investors/2020_03_23_Sanofi-Report-2019-20F-accessible.pdf?la=en&hash=14ACCB31D1FFFF966C8EA96CA7EE5049

- Chen Y, Chi X, He Y, Wei Y, Oortwijn W, Shi L. Mapping of Health Technology Assessment in China: Situation Analysis and International Comparison. Int J Technol Assess Health Care. 2019;35(5):401-407. doi:10.1017/s0266462319000709

- National Health Commission of the People’s Republic of China. China adds 74 new drugs to medical insurance coverage list. Accessed 3rd May, 2022. http://en.nhc.gov.cn/2021-12/06/c_85285.htm