Introduction

CAR T, or chimeric antigen receptor T-cell therapy, involves reprogramming the patient’s own immune system and using immune cells to target their cancer. Currently available CAR T therapies are customised for each individual patient, which makes it a highly expensive option for treatment and is therefore traditionally reserved for late stage cancers1.

CAR T-cell therapy research is taking off, with an increase in ~27 active CAR T clinical trials in 2021 vs ~514 in 2019. Regulatory approvals are also on the rise, for example the FDA are forecasted to approve ~21 in 2024 compared to only 2 in 2019. Initially focused on the CD19 antigen, CAR T-cells now target diverse antigens across various cancers, including the B-cell maturation antigen in multiple myeloma. Driving this surge is promising clinical data, like a 90% remission rate in ALL young patients with anti-CD19 CAR T therapy2.

In recent trials, CAR T therapy outperformed standard therapy for relapsed non-Hodgkin lymphoma, prompting experts to see it as a promising replacement for chemotherapy in these patients3.

However, a major hurdle in its widespread use remains: the high cost of this innovative treatment. This raises the question: can traditional pricing models, such as the “price vs volume” rule, be applied to CAR T therapy? This article delves into this crucial issue, exploring alternatives pricing models that might ensure wider access to this potentially life-saving treatment.

The price volume rule

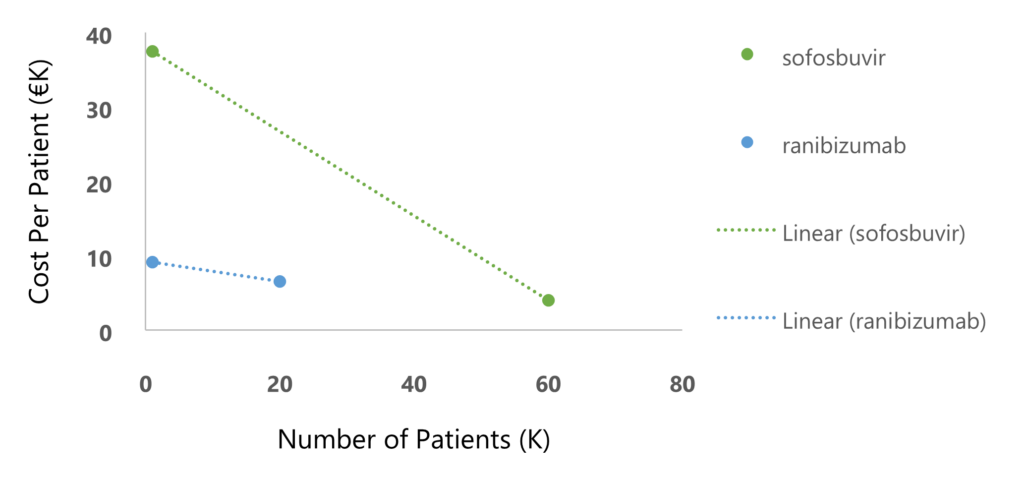

In managing drug prices at the national level, price-volume agreements are a tool aimed at ensuring sustainability in cases where the drug price is high, and the population is large. These agreements determine a progressive price reduction as more and more patients are treated. For example, in Italy, ranibizumab (for macular degeneration) and sofosbuvir (for hepatitis C), have shown a significant reduction of buyer’s expenditures for costly drugs using price-volume agreements (Figure 1)4.

Challenges in increasing the volume of CAR T therapy

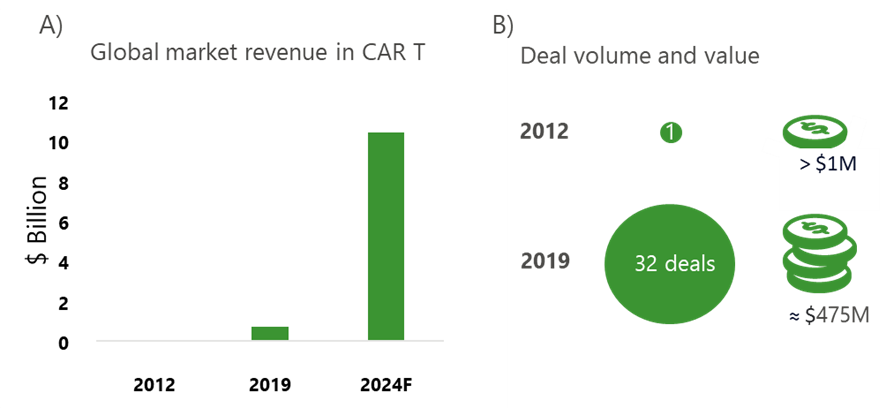

The CAR T industry has seen considerable growth in market revenues; forecasted by McKinsey & Company to be a >10X increase in the last 5 years (Fig 2A). Deal volume and value increased significantly from 2012 to 2019, demonstrating that these transformative therapies are becoming more important to payers across the world (Fig 2B).

However, scaling up CAR T therapy remains a significant challenge hindered by several factors. Firstly, the centralised manufacturing model limits production capacity, as only a small number of facilities can create the therapy. Secondly, limited economies of scale pose an obstacle. Unlike mass-produced drugs, CAR T cells are personalised, making cost reduction through increased volume difficult. Additionally, the high cost of production itself, associated with the complex process and personalised nature of the therapy, makes it expensive to deliver at a widespread scale. Finally, the patient pathway from referral to infusion is lengthy and complex, involving multiple steps including blood cell collection, transportation, conditioning chemotherapy, CAR T cell creation, patient preparation, and the infusion itself2.

Limited access and long waiting times pose a significant challenge for patients seeking CAR T therapy. A study conducted at the Mayo Clinic in Minnesota revealed a critical shortage of treatment slots, with a median of only one available per month. This scarcity creates long waiting lists, with a median of 20 patients waiting for an average of six months. Such delays can negatively impact the effectiveness of the treatment and potentially worsen patient outcomes5.

Concerns have been raised about the accessibility and affordability of CAR T therapy, particularly for multiple myeloma. Dr Edward Cliff, an Australian haematology registrar, highlighted several hurdles, including limited treatment centres, the need for bridging therapies while waiting for CAR T cells, and the significant cost exceeding $400,000 per patient. Even within the context of select trial populations, some patients tragically passed away before receiving their manufactured CAR T cells. Myeloma specifically presents unique challenges in the manufacturing process, although companies are actively investing in improving capacity5.

Currently, CAR T therapy is primarily used to treat patients with specific types of blood cancers (liquid tumours) that have relapsed or proven resistant to other treatments. Optimising the manufacturing of autologous CAR T cells (derived from a patient’s own T cells) from liquid tumours could potentially expand access to this therapy for more patients. Additionally, research aiming to shorten the development cycle for CAR T therapy targeting solid tumours holds promise for future application. To meet the growing demand for this innovative treatment, it is crucial to focus on innovative solutions for next-generation CAR T therapy manufacturing3.

Pricing models being used for CAR T therapies

In a 2023 report exploring key learnings from members of the Alliance for regenerative medicine, seven out of the eight newly launched advanced therapeutic medicines, achieved some degree of reimbursement across Europe. In countries where innovative contracts were not implemented, manufacturers commonly entered into more conventional agreements. One manufacturer reported that in 11 countries (including two non-European), access was gained solely via simple discounts without innovative contracting6.

According to a systematic review on financing and reimbursement models for personalised medicines, cell therapies are often provided with rebates on non-outcome-based reimbursement models7. Other aspects of CAR T pricing are associated with complex bundled agreements with hospitals and payers for covering costs of various components of treatment delivery like procedures for pretesting patients, post-CAR T response assessments and management of toxicities8.

Kymriah and Yescarta are well-known for notoriously high list prices, which are relatively uniform across the EU5 (list prices of ~€320K and ~€327K, respectively). Despite this, both treatments are reimbursed in all 5 countries. In France and the UK, reimbursement is on the condition of collecting additional data (at the cohort level) and subject to future reassessments; elsewhere, rebates (Germany) or staged payments (Italy and Spain) are linked to individual patient outcomes9.

Conclusion and industry impact

For traditional products, cost of manufacture and distribution tend to be low compared to development costs. In these cases, pricing strategies are often aimed at revenue optimisation using price-volume agreements and incremental value. Interest in CAR T therapies is increasing, and they are being continually improved to become more accessible. However, there are no price-volume agreements in sight for these transformative therapies, due to challenges such as high cost per patient, speed of manufacture and number of suitable clinics.

CAR T therapies are currently being accessed through conditional reimbursement, rebates, or staged payments. Licensing agreements, especially by universities and academic institutions receiving public funding, are also enhancing access, and encouraging competition8. In the future, CAR Ts may become more accessible and see a decrease in price by fine tuning the process from manufacture to administration, however, these highly specialised medicines are unlikely to become relevant for price-volume agreements.

Sources:

- C Gyeyoung, S Gyeongseon. Price and Prejudice? The Value of Chimeric Antigen Receptor (CAR) T-Cell Therapy. International Journal of Environmental Research and Public Health. 2022; 19(19):12366

- Nam S, Smith J, Yang G. Driving the next wave of innovation in CAR T-cell therapies. McKinsey & Company; 2019.

- CAR T Cells: Engineering Immune Cells to Treat Cancer, accessed on 24/02/2024: https://www.cancer.gov/about-cancer/treatment/research/car-t-cells

- Messori A. Criteria for Drug Pricing: Preliminary Experiences with Modeling the Price-Volume Relationship. Scientia Pharmaceutica. 2016;84(1):73-79

- T Rodriguez. Cost and Allocation of Scarce CAR-T Therapy for Patients With Multiple Myeloma. Oncology Nurse Advisor; 2023

- Innovative contracting for ATMPs in Europe: Recent learnings from the manufacturer experience. Alliance for Regenerative Medicine, prepared by Dolon; 2023

- R Koleva-Kolarova, J Buchanan, et al. Financing and Reimbursement Models for Personalised Medicine: A Systematic Review to Identify Current Models and Future Options. Applied Health Economics and Health Policy. 2022;20:501-524

- E R Scheffer Cliff, A H Kellar et al. High Cost of Chimeric Antigen Receptor T-Cells: Challenges and Solutions. Developmental therapeutics – immunotherapy, 2023;43(43)

- J Jorgensen, E Hanna, P Kefalas. Outcomes-based reimbursement for gene therapies in practice: the experience of recently launched CAR-T cell therapies in major European countries. Journal of Market Access and Health Policy. 2020;8(1): 1715536