Negotiations between the Trump administration and pharmaceutical companies on lowering U.S. prescription drug prices to match those of other countries appear to be ongoing despite the September 29 deadline passing. The deadline for the most favoured nation (MFN) executive order in the United States (U.S.) was supposed to mark an important milestone. However, in practice reaching an agreement with at least 17 drugmakers will likely require additional interim deadlines and significant flexibility on both sides of the negotiating table, before a resolution is reached.1,2

The MFN Executive Order seeks to align U.S. drug prices with those paid in other countries, where prices are typically much lower. For manufacturers, navigating the complexities of each market while adapting to the requirements of MFN presents significant challenges. More specifically, reconciling drug pricing disparities in the U.S. versus European countries requires navigating fundamental differences in how healthcare is financed in each country.

While the policy ultimately seeks to rebalance the extent to which US patients contribute to financing pharmaceutical innovation relative to other developed nations, the MFN policy could have broader implications for the sustainability of the current pharmaceutical innovation business model, and for patient access to new therapies globally. Most notably, there are signs that the policy will influence how manufacturers set prices in international reference markets, even if it comes at the expense of access, given the outsized share of the U.S. in the global pharmaceutical market – as illustrated by Bristol Myers Squibb’s recent actions regarding Cobenfy. Further, this development presents potential access challenges not only for established European markets, but also for less-established markets since European list prices are extensively referenced globally.

A main challenge for pharmaceutical companies is figuring out how to navigate the reorganisation of the U.S. pricing system, while minimising consequential ripple effects in other markets. Also, there is still significant uncertainty around the potential impact of MFN on confidential net prices and contracting strategies elsewhere. This article will examine the MFN Drug Pricing Proposal and its potential implications for global pricing strategy.

The Trump Administration’s Drug Pricing Executive Orders

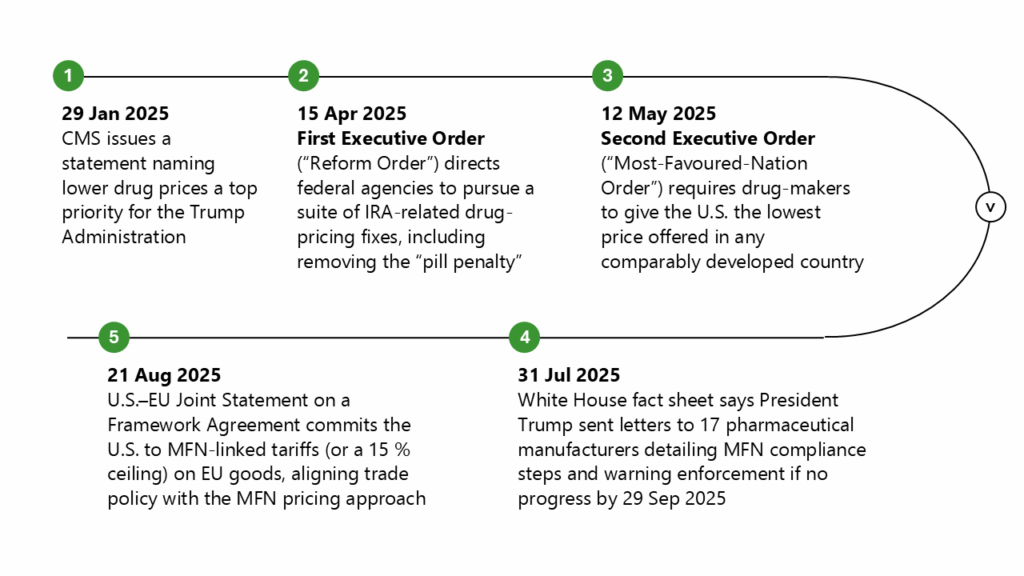

It is important to review the latest actions by the Trump administration in recent months to reduce drug costs and facilitate change (see figure below).

Note: CMS: Centers for Medicare & Medicaid Services; EU: European Union; IRA: Inflation Reduction Act; MFN: Most-favoured-nation; U.S.: United States

References: 1-5

The Cobenfy Case: What They Announced & Why It Matters

Interestingly, Bristol Myers Squibb (BMS) announced it will set the UK list price for its schizophrenia medication Cobenfy at approximately $1,850 per month, matching the U.S. list price.6 This move aligns with the Trump administration’s executive orders aimed at encouraging international drug price alignment with the U.S.

In 2024, the U.S. Food and Drug Administration (FDA) approved Cobenfy (xanomeline and trospium chloride), a new antipsychotic designed for treating schizophrenia in adults. It marks the first antipsychotic approved for schizophrenia that targets cholinergic receptors instead of the traditional dopamine receptors.7 BMS intends to launch it in the UK in 2026, making the UK the first country in Europe to have this medication available. This is a notable move, as the company discloses its pricing approach ahead of filing for UK regulatory approval, expected later this year.6 It also marks the first time BMS has established the same list prices in both markets.

These points underscore the rising tensions between governments and manufacturers, when it comes to balancing strained budgets and the industry’s recent moves to challenge established norms. This trend is also visible in recent VPAG (Voluntary Scheme for Branded Medicines Pricing, Access and Growth) negotiations between the industry and the UK government. Under the UK’s VPAG scheme, companies agree to refund a part of their branded drug sales to the NHS. Recently, negotiations failed to reach an agreement on scheme modifications, with the UK government reinforcing higher rebate rates (35.6%) than most countries.8

List vs Net Pricing Dynamics

The Office of Health Economics (OHE) has identified several scenarios related to the implementation of MFN policy. They note that manufacturers might increase ex-U.S. (e.g., European) list prices to match U.S. levels, while relying on confidential net prices to navigate the complexities of each market and ensure patient access.

Although list prices are publicly available, many factors influence the final net price, including confidential discounts and rebates negotiated with payers.9 This is particularly common in the UK, where drug assessments take into account cost-effectiveness thresholds, such as QALY (Quality-Adjusted Life Year), and greatly depend on confidential patient access scheme agreements.10

Recent developments favour the OHE scenario. Eli Lilly and Company, the U.S. manufacturer of tirzepatide (Mounjaro), announced that starting September 1, the UK price for its highest-strength Mounjaro injection will rise by 170%, from £122 to £330.11 Furthermore, Germany has recently implemented a policy permitting manufacturers to keep negotiated reimbursement prices confidential, suggesting a similar trend is likely to play out in European markets also.12

The OHE concluded that global price ranges would be protected under this scenario, but this could lead to prolonged health technology assessment negotiations and delays in market launches close to the MFN threshold. Additionally, the study also alludes to the potential of higher list prices skewing perceptions of cost-effectiveness overall.9

Conclusion

Implementing the MFN pricing policy presents strategic challenges for pharmaceutical companies and European governments alike. It is already leading to increasing European list prices to minimise potential impact on U.S. revenues, causing a ripple effect on global reference prices. Consequently, pharmaceutical companies must navigate conflicting goals: ensuring affordability and patient access to innovative drugs globally, while protecting the sustainability of the current pharmaceutical business model and securing incentives for long-term investment in pharmaceutical innovation.

This underscores the ever-increasing importance of a comprehensive global pricing strategy that incorporates multiple scenario planning, early payer engagement, risk mitigation strategies, and the use of confidential discounts or outcome-based agreements to safeguard access. To examine the US policy shift and its potential effects (MFN), join Remap Consulting for an interactive office hours session on October 9th. Register here.

References

- Rogers H-A. Most-Favored-Nation Prescription Drug Pricing Executive Order: Legal Issues. Library of Congress. Accessed 29/09/2025, https://www.congress.gov/crs-product/LSB11319

- The White House. Fact Sheet: President Donald J. Trump Announces Actions to Get Americans the Best Prices in the World for Prescription Drugs. The White House. Accessed 29/09/2025, https://www.whitehouse.gov/fact-sheets/2025/07/fact-sheet-president-donald-j-trump-announces-actions-to-get-americans-the-best-prices-in-the-world-for-prescription-drugs/

- European Commission. Joint Statement on a United States-European Union framework on an agreement on reciprocal, fair and balanced trade. European Commission. Accessed 29/09/2025, https://policy.trade.ec.europa.eu/news/joint-statement-united-states-european-union-framework-agreement-reciprocal-fair-and-balanced-trade-2025-08-21_en

- The White House. DELIVERING MOST-FAVORED-NATION PRESCRIPTION DRUG PRICING TO AMERICAN PATIENTS. The White House. Accessed 29/09/2025, https://www.whitehouse.gov/presidential-actions/2025/05/delivering-most-favored-nation-prescription-drug-pricing-to-american-patients/

- The White House. LOWERING DRUG PRICES BY ONCE AGAIN PUTTING AMERICANS FIRST. The White House. Accessed 29/09/2025, https://www.whitehouse.gov/presidential-actions/2025/04/lowering-drug-prices-by-once-again-putting-americans-first/

- Bristol Myers Squibb. Bristol Myers Squibb plans to launch Cobenfy (xanomeline and trospium chloride) in the UK at a list price equal to the US launch price. Bristol Myers Squibb,. Accessed 29/09/2025, https://www.bms.com/gb/media/press-release-listing/bristol-myers-squibb-plans-to-launch-cobenfy-in-the-uk-at-a-list-price-equal-to-the-us-launch-price.html

- U.S. Food and Drug Administration. FDA Approves Drug with New Mechanism of Action for Treatment of Schizophrenia. U.S. Food and Drug Administration. Accessed 29/09/2025, https://www.fda.gov/news-events/press-announcements/fda-approves-drug-new-mechanism-action-treatment-schizophrenia

- The Association of the British Pharmaceutical Industry. Accelerated review of VPAG concludes without agreement. The Association of the British Pharmaceutical Industry. Accessed 29/09/2025, https://www.abpi.org.uk/media/news/2025/august/accelerated-review-of-vpag-concludes-without-agreement/

- Cookson G, Cole A, Berdud M. The Trump Administration’s US Drug Pricing Proposal – What will happen next? the Office of Health Economics. Accessed 29/09/2025, https://www.ohe.org/insights/the-trump-administrations-us-drug-pricing-proposal-what-will-happen-next/

- NHS England. NHS commercial framework for new medicines. NHS England. Accessed 29/09/2025, https://www.england.nhs.uk/long-read/nhs-commercial-framework-for-new-medicines/

- Bowie K. Mounjaro: UK price set to rise by up to 170% after Trump complaint—will patients have to pay? BMJ. 2025;390:r1776. doi:10.1136/bmj.r1776

- Gemeinsamer Bundesausschuss. Sozialgesetzbuch (SGB) Fünftes Buch (V) – Gesetzliche Krankenversicherung – (Artikel 1 des Gesetzes v. 20. Dezember 1988, BGBl. I S. 2477). Gemeinsamer Bundesausschuss. Accessed 29/09/2025, https://www.gesetze-im-internet.de/sgb_5/__130b.html