A focus on the new proportionate approach, and the international recognition programme.

Introduction

In this article we explore whether the UK’s place in companies’ launch priorities has slipped and whether it continues to fall in attractiveness. Changes such as Brexit were the first to cause uncertainty in launching in the UK but in the last year several changes have been made or proposed, such as the new VPAG scheme and the proportionate approach, which could change the pharmaceutical industry’s perception of the attractiveness of the UK market. In addition, the MHRA can now use regulatory acceptance from several different markets as part of the international recognition framework, but also saw large delays in the last year to grant approval. Here we specifically discuss events at NICE and the MHRA which may impact the attractiveness of the launch in the UK.

Assessment of the change of attractiveness of the UK market

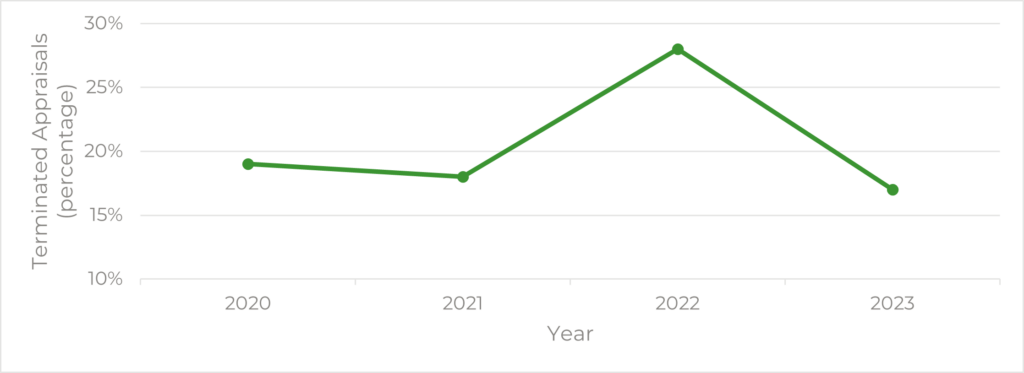

One way that we can look at how attractive the pharmaceutical industry believes the UK to be is by looking at terminated NICE appraisals, where we can see which products were not submitted to NICE. Although there are several reasons why a company may decide not to submit, it can provide an indication of willingness to spend resources on launching in the UK.

In 2022, the number of terminated single technology appraisals leapt to 28% from 18% in 2021, although the number in 2023 was much closer to that in previous years (Figure 1). From the data, it appears 2022 may have been an outlier, and it is unclear whether the number of terminated appraisals is trending upwards. Reviewing this data for 2024 will be interesting.

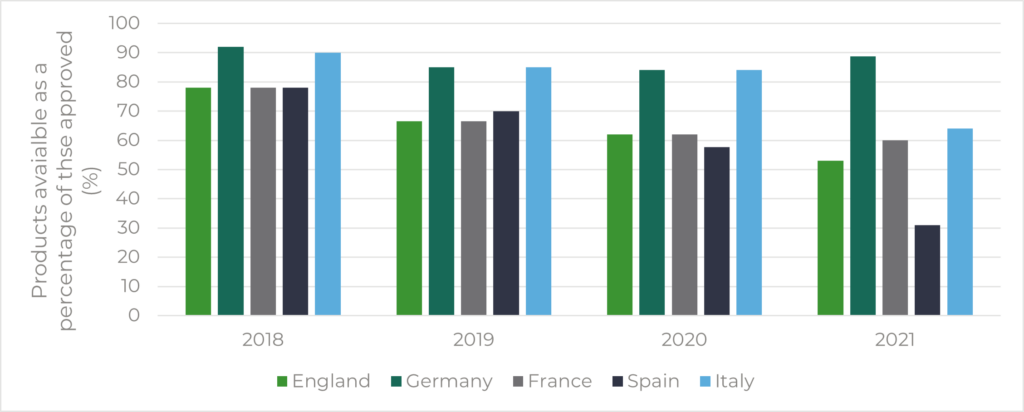

E.F.P.I.A’s W.A.I.T indicator survey provides another source of data. In England, the number of drugs accessible to patients has been falling in relation to the total number of approvals (78% in 2018 compared to 53% in 2021) (Figure 2). However, this trend was also seen across the EU4 (Figure 2). Other factors may also be at play, such as the increasing cost control measures making it harder for pharmaceutical companies to obtain a price that supports their business case, or more stringent assessments to get onto national or local formularies.

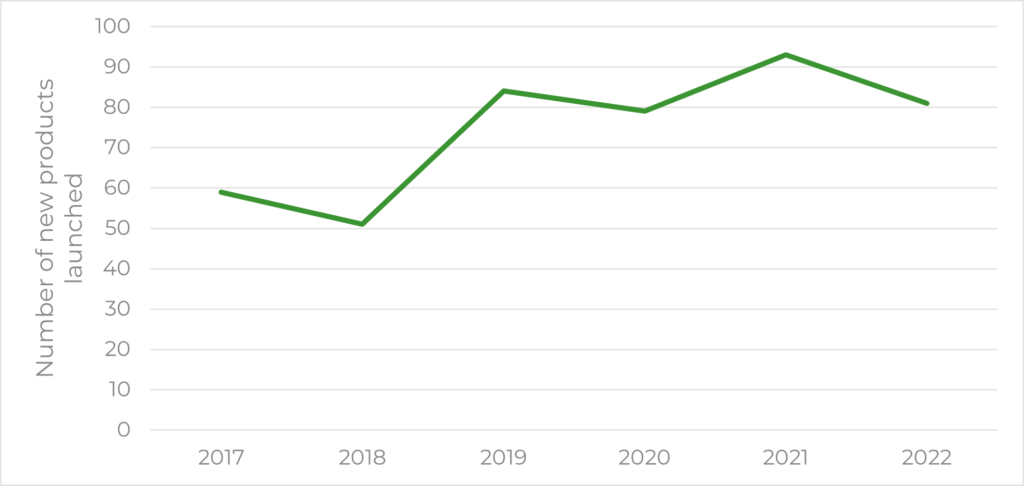

Finally, we looked at the number of new launches in the UK since 2017 (Figure 3) taken from the NHS’s list of new product launches. From these numbers, it looks as though there is a general positive increase in the number of products launched each year in the UK though this data does consider all product launches including all of those which may have not gone to NICE.

Overall, the data suggests that the UK may not be reducing in attractiveness but rather staying the same or following European trends in terms of reduction in availability of products launched. However, recent proposed or implemented changes in the regulatory approval and HTA assessment process may affect this moving forwards. Here we discuss two potential changes that could affect this: NICE’s proportionate approach and the international recognition procedure.

Proportionate approach

NICE launched phase 1 and 2 of its proportionate approach to technology appraisals in 2023. This aims to increase NICE’s capacity for publishing appraisals by 20% from 2023 to 2024 onwards, allowing evaluations to follow different paths that match their specific needs (i.e., faster processes for simple topics), and using a ‘test-and-learn’ approach to explore different approaches. For manufacturers, this could mean faster access and greater collaboration with NICE but it could also cause unpredictability in the assessment process and cause manufacturers to lose control of aspects of the application. However, we anticipate that generally only low-risk appraisals will be routed to a streamlined approach, so in most situations it should give companies a faster and less resource-intensive route to market in the UK.

International recognition procedure

Following Brexit, the UK’s regulatory body, the MHRA (Medicines and Healthcare Products Regulatory Agency) could no longer automatically rely on the decisions of the EMA (European Medicines Agency). To bridge the gap so that the MHRA would not have to drastically increase their capacity in a short period of time the ECDRP (European Commission (EC) Decision Reliance Procedure) was set up. A product approved by the EC would only require a short 67-day application before getting approval for use in the UK. However, with the end of 2023 came the end of the ECDRP.3

In its place is the new International Recognition Procedure which came into force in 2024, allowing the MHRA to conduct targeted assessments by recognising approvals from trusted partner agencies. The procedure is available for drugs with an authorisation from one of the seven countries/regions with approved Reference Regulators which are Australia, Canada, European Commission (replaces ECDRP), Japan, Switzerland, Singapore and the USA. Products will fall into either category A or B depending on their characteristics, which will impact the timeline to approval.4

This route allows additional flexibility for manufacturers, however, as many innovative products will fall into category B this will not allow such a time saving and is not as favourable as the procedure’s predecessor, the ECDRP. Therefore, it is still more complex than pre-Brexit and it may cause longer waits before drugs are accessible in the UK. On top of this, we have heard anecdotally that in 2023 companies faced sometimes considerable delays in navigating the MHRA approval process.

Conclusion and the impact on manufacturers

So, is the UK becoming less attractive? Certainly, Brexit caused uncertainty, but the data is unclear as to whether companies are deprioritising the UK in new drug launches. The UK’s large population compared to many countries in Europe, the willingness to offer confidential discounts so as not to impact international reference pricing, and the sometimes very rapid access (in some cases straight after MA) means that despite the changes, a launch in the UK will still be a high priority for many manufacturers. Moreover, many other countries will look positively on a successful NICE appraisal, which may keep manufacturers keen to gain access in the UK. However, with the advent of the Joint EU HTA the focus may shift and countries may place greater weight on the joint clinical assessment rather than the NICE outcome, though this is speculative. Changes to rebates, namely with the VPAG and statutory scheme, may also have an impact on the NICE attractiveness and shall be discussed in length in our next article.

Read more about VPAG > click here

Sources:

- EFPIA. EFPIA Patients W.A.I.T. Indicator 2022 Survey https://www.efpia.eu/media/s4qf1eqo/efpia_patient_wait_indicator_final_report.pdf. Accessed 7th Feb 2024

- NHS. List of new product launches. https://www.sps.nhs.uk/articles/lists-of-new-product-launches/. Accessed 7th Feb 2024

- Medicines and Health care Products Regulatory Agency. Consultation on end to the European Commission Decision Reliance Procedure. https://www.gov.uk/government/consultations/consultation-on-end-to-the-european-commission-decision-reliance-procedure/consultation-on-end-to-the-european-commission-decision-reliance-procedure#:~:text=While%20the%20European%20Commission%20Decision,found. Accessed 7th Feb 2024.

- ABPI. MHRA’s new International Recognition Procedure (IRP): how does it shape up? https://www.abpi.org.uk/media/blogs/2023/september/mhra-s-new-international-recognition-procedure-irp-how-does-it-shape-up/. Accessed 7th Feb 2024.