Introduction

On 20 November 2023, a new deal was agreed between the UK government, NHS England and the pharmaceutical industry. The agreement will be referred to as VPAG (Voluntary scheme for branded medicines Pricing, Access and Growth) and is scheduled to remain in effect until 2028. Its main objective is to strike a balance between maintaining the affordability of NHS medicines whilst providing a fair return to the industry1. However various stakeholders have raised issues suggesting that VPAG will not come without its challenges and limitations2.

What are the objectives of VPAG and what led to it’s establishment?

A clear objective of the VPAG is cost-savings. Approximately £14 billion is estimated to be saved for the NHS over 5 years and an extra £400 million is expected to be invested in UK clinical trials, manufacturing and innovative health technology assessment in a bid to enhance the UK’s global competitiveness and attractiveness for research & development1. An integral component of this arrangement is the affordability mechanism, whereby scheme members reimburse a portion of their earnings from medicine sales back to the government if the total expenditure on branded medicines surpasses a predetermined threshold1.

The decision to introduce VPAG was driven primarily by significant challenges faced by the prior agreement – Voluntary Scheme for Branded Medicines Pricing and Access (VPAS). The rebate rate of 26.5% caused disruption and concerns within the pharmaceutical sector, so much so that AbbVie and Eli Lilly departed from VPAS claiming it “harmed innovation” and made it “increasingly difficult” to advocate for the UK market to shareholders4. VPAG has attempted to address these problems through various non-financial features:

- Two new innovative payment model pilots for ATMPs (advanced therapy medicinal products) have been created to make ATMPs a more attractive area for developers to invest towards. However, public information on these pilots is not currently available, limiting the ability to which we can say they will affect manufacturers3

- The budget impact test may rise from £20m to £40m thereby offering greater flexibility towards manufacturers3

How does VPAG differ from VPAS?

VPAG was introduced to replace VPAS (Voluntary Scheme for Branded Medicines Pricing and Access) following exceedingly high rebate rates. These rates were not seen in any other country resulting in several manufacturers leaving the UK market because they couldn’t operate sustainably.

| VPAS | VPAG | |

| Period covered | Jan 2019 – Dec 2023 | Jan 2024 – Dec 2028 |

| Annual growth rate | 2% | To increase to 4% by 2027 Baseline adjustments included |

| Product categories | None | New (first licence < 12 years ago) and old products |

| Rebate | 5.9% – 26.5% | New products: dynamic (amended each year to keep sales growth within allowed sales) – 19.5% in Q1 2024 Older Products: 10% basic, plus up to 25% depending on recent price cuts |

| Exemptions | 3 years post MA Small and medium companies’ exemption taper of £5m and £25m sales respectively | Continuation of exemption for new active substances (3 years post MA) Small and medium companies’ exemption taper of £6m and £30m sales respectively |

(Abbreviations: MA: Marketing authorisation; VPAG: Voluntary Scheme for Branded Medicines Pricing, Access and Growth; VPAS: Voluntary Scheme for Branded Medicines Pricing and Access)

Statutory scheme

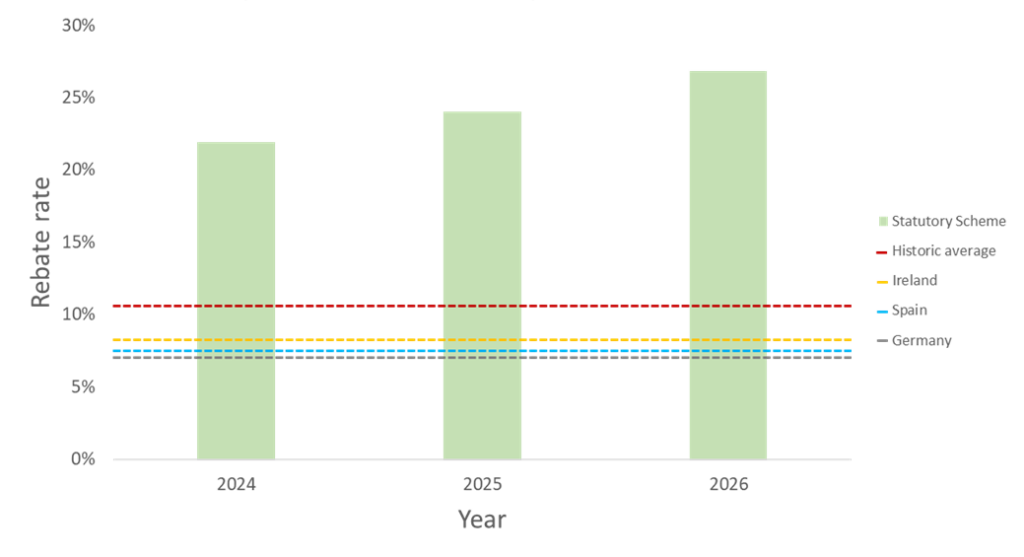

If manufacturers do not sign up to VPAG for their branded medicines, then they must be part of the Statutory Scheme. The Statutory Scheme was renegotiated in 2023 and will have rebates of 21.9%, 24%, and 26.8%, in 2024, 2025, and 2026, respectively, with the option remaining to amend payment rates to account for updated data or maintain broad commercial equivalence with the final version of VPAG6. This has been met with backlash from the ABPI which has accused the government of sending “mixed messages” and that the Ministry of Health has “damaged the UK’s international standing with global life science companies”7.

Whilst the rebate rates have reduced from 2023’s record high of 27.5%, the new rates lie well above the historical average of 10.6% prior to 2023. The UK’s new statutory rebate rate is also significantly higher when compared to other European markets, such as 7% in Germany, 7.5% in Spain, and 8.25% in Ireland7 (see figure 2).

Is the UK market still attractive to global pharmaceutical manufacturers?

The level of opposition encountered by VPAG is not as pronounced as that faced by VPAS, though this dynamic could evolve as VPAG becomes more established over time. The new scheme generally provides a more favourable environment for growth, with commitments to review and improve commercial conditions for branded medicines. APBI has welcomed VPAG stating that “the prospect of lowering rebate rates over time is seen as a positive step”8. Nevertheless, it is important to acknowledge that VPAG will impact companies in varying ways. Those with portfolios predominantly comprising of older medicines, whose prices have consistently remained high, may encounter challenges under the new agreement8.

Accordingly, the British Generic Manufacturers Association (BGMA) has questioned the detail of the newly agreed VPAG scheme, warning that price erosion calculations could damage competition and lead to drug shortages9. This indicates that the perception of how VPAG will influence the UK market over the next five years may vary among different stakeholders. However, it is expected that VPAG is unlikely to affect the UKs position in the global launch order rankings (currently sitting 7th according to latest research)10. This is due to numerous factors impacting the UK’s position, and considering VPAG is perceived as an improvement over VPAS, it implies that the UK is likely to remain an attractive market.

So what does this mean?

VPAG is a ground-breaking agreement that aims to align the interests and goals of the UK government, the pharmaceutical industry, the NHS, and patients. It represents a significant departure from the VPAS, introducing a novel model poised to unlock substantial benefits. This potential extends to faster patient access to life-saving treatments, a more robust NHS empowered by financial sustainability, and a thriving UK life sciences sector at the forefront of innovation. Despite these promising aspects, the scheme does pose challenges and risks to the market access of branded medicines in the UK. Older branded medicines are most at risk whilst newer products will be less restricted. With that in mind, the UK is likely to remain an attractive market for branded medicines as VPAG represents a notable improvement over its predecessor, VPAS.

Immerse yourself fully in the new VPAG and it’s impact by watching our webinar – available here.

The webinar includes discussions on:

- Key differences between the VPAS and VPAG

- VPAS investment programme

- Factors influencing rebate calculations

- Rebate calculations for older and newer medicines

- Answers to audience-asked questions

Sources:

- Debate on the voluntary scheme for branded medicines and the Life Sciences Vision. https://commonslibrary.parliament.uk/research-briefings/cdp-2023-0097/#:~:text=The%20VPAS%20is%20a%20voluntary,market%20new%20and%20improved%20medicines. Accessed 22nd February 2024

- VPAG – New 5-Year Pricing Agreement Agreed between UK Government and the UK Pharmaceutical Industry Body (ABPI). https://www.insideeulifesciences.com/2023/11/29/vpag-new-5-year-pricing-agreement-agreed-between-uk-government-and-the-uk-pharmaceutical-industry-body-abpi/. Accessed 22nd February 2024

- 2024 Voluntary Scheme for Branded Medicines Pricing, Access and Growth. https://assets.publishing.service.gov.uk/media/657b2977095987001295e139/2024-voluntary-scheme-for-branded-medicines-pricing-access-and-growth.pdf. Accessed 22nd February 2024

- Mahase M. AbbVie and Eli Lilly leave UK pricing scheme over revenue repayment. BMJ. 2023;380:p207.

- 2024 voluntary scheme for branded medicines pricing, access and growth: summary of the heads of agreement. https://www.gov.uk/government/publications/2024-voluntary-scheme-for-branded-medicines-pricing-access-and-growth-summary-of-the-heads-of-agreement/2024-voluntary-scheme-for-branded-medicines-pricing-access-and-growth-summary-of-the-heads-of-agreement. Accessed 22nd February 2024.

- Review of the scheme to control the cost of branded health service medicines: consultation response. https://www.gov.uk/government/consultations/review-of-the-scheme-to-control-the-cost-of-branded-health-service-medicines/outcome/review-of-the-scheme-to-control-the-cost-of-branded-health-service-medicines-consultation-response#executive-summary. Accessed 22nd February 2024.

- Government sends mixed message to global life science investors. https://www.abpi.org.uk/media/news/2023/december/government-sends-mixed-message-to-global-life-science-investors/. Accessed 22nd February 2024.

- 2024 Voluntary Scheme agreement published. https://www.abpi.org.uk/media/news/2023/december/2024-voluntary-scheme-agreement-published/. Accessed 22nd February 2024.

- VPAG rebate calculations risk NHS drug shortages, warns BGMA. https://www.thepharmacist.co.uk/news/vpag-rebate-calculations-risk-nhs-drug-shortages-warns-bgma/. Accessed 22nd February 2024.

- Comparing New Prescription Drug Availability and Launch Timing in the United States and Other OECD Countries. https://aspe.hhs.gov/sites/default/files/documents/430a3e61c234f06270b04414e797ad3a/new-drug-availability-launch-timing.pdf. Accessed 22nd February 2024.