The pharmaceutical industry is increasingly recognising the need for specialised pricing and market access (PMA) teams to secure reimbursement at a price reflective of product value.

As previously highlighted in our “What does a Global Market Access Team do?” article1, achieving a reimbursed price requires dedicated personnel to craft an overall access strategy and pricing approach for each product. The PMA team has a range of responsibilities and functions, broadly spanning pricing strategy, reimbursement negotiations, and health economics and outcomes research. These teams are crucial in understanding payer requirements, developing early value narratives, and ensuring clinical and economic evidence aligns with payer expectations. Their role should extend from early product development through post-marketing, coordinating with global and regional affiliates to navigate health technology assessments (HTAs) and international reference pricing (IRP) considerations.

However, the structure of PMA teams may often differ across organisations. This raises important questions: What does the right market access organisation structure look like? And are today’s companies best structured to ensure market access is sufficiently considered throughout product development and launch?

Seniority of PMA representation

When evaluating a market access function, the first element to consider is the influence wielded by the team within the organisation. One need only look at the board: Is there a market access representative among its members? If not, where does the most senior market access colleague fit within the hierarchy?

A senior PMA representative in a high-level position can significantly enhance market access success. Crucially, a PMA leader can promote the importance of PMA, ensuring its integration into the overall strategy from early product development. They may also have the means to influence the allocation of resources, drive the development of specialised training, and foster cross-functional collaboration by aligning objectives across departments.

Interestingly, our analysis of a sample of large, medium, and small pharmaceutical companies suggests that it is mainly the small pharmaceutical companies with PMA representation in more senior positions. While the large and medium-sized companies we looked at tended to lack senior PMA representation, small companies had senior PMA representatives on their executive and leadership teams.

This could be attributed to the fact that the larger pharmaceutical companies were established before the advent of HTAs, when demonstrating payer value was less of a barrier to patient access. In contrast, newer, smaller companies have the opportunity to integrate market access more fundamentally into their operations. To remain competitive as industry innovation leaders, it may be important for the larger companies to adapt their complex operations to further promote PMA considerations.

Market access cannot be achieved only from within the market access team

To truly optimise market access, the PMA team must have influence throughout the entire company and provide inputs at every stage of the development process. This requires them to be well connected with other functions, guiding decisions to get rapid patient access to new treatments. Connecting teams can be approached in two ways: through a hierarchy that spans all portfolios and stages of development or through teams dedicated to specific portfolios and stages. Each approach has its pros and cons, but one thing remains clear. If a company values market access, all teams must be committed to making strategic decisions with the goal of increasing the likelihood of a positive HTA assessment.

So, what does the right market access organisation look like?

The answer to this question can vary significantly between companies, as each is organised and operated differently. Ultimately, the ideal market access structure is likely one that mirrors the existing organisational structure to allow for synergy and seamless integration. It is crucial that perspectives from colleagues across the entire organisation are aligned to ensure cohesive strategy and execution. For smaller companies, a more flexible and integrated market access team might be necessary, whereas medium-sized companies could benefit from a more defined and hierarchical approach. Similarly, the approach may differ between companies focusing on orphan assets, which may require specialised and targeted strategies, versus those working in well-defined therapeutic areas, where a broader, more standardised approach might be practical.

Another important question to consider is what size should the PMA function be? We analysed the organisational structures of the current top 10 pharmaceutical companies2, using publicly available employment data3-12. We inferred the approximate sizes of these organisations and compared them to the number of employees in market access-specific roles.

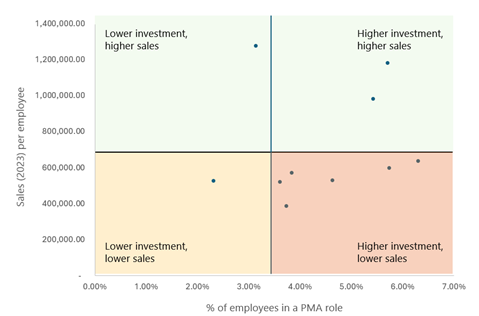

Figure 1 explores the investment in PMA (measured as the proportion of employees with a PMA role) versus company sales (proportional to company size). This reveals some variation in the proportion of employees in PMA roles, indicating that some companies may not be sufficiently investing in this critical function. To gain a more comprehensive understanding, conducting similar analyses for smaller companies and further exploring how these PMA roles are structured across different organizational levels and departments would be beneficial.

Figure 1: 2023 sales2 (per employee) versus percentage of employees in a pricing and market access role3-12 for the top 10 pharmaceutical companies.

Conclusion

In conclusion, there is no one-size-fits-all approach to structuring a PMA team, but we consider senior PMA representation to be critical for optimising market access success. Ultimately, the goal is to ensure that all teams within a company are aligned and committed to strategic decision-making that prioritises market access for the benefit of patients.

Sources:

- Foxon G. What does a Global Market Access Team do?. Remap Consulting. December 13, 2021. Accessed August 08, 2024. https://remapconsulting.com/hta/what-does-a-global-market-access-team-do/#:~:text=Typically%2C%20the%20responsibility%20of%20the,products%20in%20the%20company%20portfolio. Accessed: 5th August 2024.

- Burke H. Who are the top 10 pharmaceutical companies in the world? (2024). Proclinical. July 30, 2024. Accessed August 05, 2024. https://www.proclinical.com/blogs/2024-7/who-are-the-top-10-pharma-companies-in-the-world-2024

- LinkedIn. GSK people. LinkedIn. Undated. Accessed August 08, 2024. https://www.linkedin.com/company/gsk/people/

- LinkedIn. Bristol Myers Squibb people. LinkedIn. Undated. Accessed August 08, 2024. https://www.linkedin.com/company/bristol-myers-squibb/people/

- LinkedIn. Novartis people. LinkedIn. Undated. Accessed August 08, 2024. https://www.linkedin.com/company/novartis/people/

- LinkedIn. AstraZeneca people. LinkedIn. Undated. Accessed August 08, 2024. https://www.linkedin.com/company/astrazeneca/people/

- LinkedIn. Sanofi people. LinkedIn. Undated. Accessed August 08, 2024. https://www.linkedin.com/company/sanofi/

- LinkedIn. Pfizer people. LinkedIn. Undated. Accessed August 08, 2024. https://www.linkedin.com/company/pfizer/people/

- LinkedIn. Johnson & Johnson people. LinkedIn. Undated. Accessed August 08, 2024. https://www.linkedin.com/company/johnson-&-johnson/people/

- LinkedIn. AbbVie people. LinkedIn. Undated. Accessed August 08, 2024. https://www.linkedin.com/company/abbvie/people/

- LinkedIn. Merck people. LinkedIn. Undated. Accessed August 08, 2024. https://www.linkedin.com/company/merck/people/

- LinkedIn. Roche people. LinkedIn. Undated. Accessed August 08, 2024. https://www.linkedin.com/company/roche/people/