What does the NHS England Commercial Framework mean for manufacturers

It is no secret that the NHS, like many other healthcare systems, is under increasing financial pressure. At the same time, the pharmaceutical industry is seeing the launch of increasing numbers of innovative medicines, often associated with price tags that create challenges of affordability and cost-effectiveness. Recognising this, NHS England is developing a new Commercial Framework, outlining potential opportunities for commercial flexibilities to enable patient access to innovative medicines whilst maintaining “value for money for taxpayers”.

Earlier this year, Remap Consulting wrote about the 2019 Voluntary Scheme for Branded Medicines Pricing and Access (VPAS) agreement which, amongst other commitments, announced that NHS England would be developing and publishing the new Commercial Framework. In early November 2019, a draft version of this agreement was published for consultation.

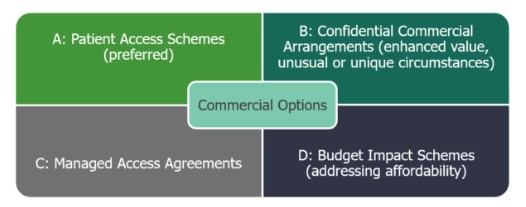

The draft Framework summarises four potential commercial situations for manufacturers, as highlighted in Figure 1.

Figure 1 Commercial Options outlined in NHS England’s draft Commercial Framework

A. Patient Access Schemes (PAS)

PAS have been available for several years as the default commercial option considered by NHS England and have been used as a mechanism to help demonstrate cost-effectiveness. PAS can involve either simple confidential discounts applied to the list prices of products (preferred by NHS England) or complex arrangements (not confidential and requiring strong justification for use).

B. Confidential Commercial Agreements

These represent new commercial opportunities agreed at the discretion of NHS England and can be used for products expected to have value propositions at or below the standard NICE cost-effectiveness ratio, where pharmaceutical companies propose an “enhanced value offer”. The draft Commercial Framework states that these may include budget caps, price-volume agreements, cost-sharing, stop/start criteria or payment-by-result schemes. Unlike complex PAS, these agreements are confidential.

In addition, the Framework outlines that NHS England will be open for discussions on commercial flexibility in cases where indication expansion may be associated with commercial challenges. For instance, in cases where uniform pricing may lead to a reduction in total overall revenues due to the introduction of additional indications and the loss in revenue is not expected to be recoverable in later years and if there is significant health gain with clear differentiation between indications. Unfortunately, there is still a lack of clarity of how commercial flexibility with indication expansions will be implemented, with limited information in the draft framework.

C. Managed Access Agreements

Managed access agreements incorporating a data collection period and a commercial arrangement have been used since July 2016 within the Cancer Drugs Fund (CDF). The Commercial Framework outlines that such agreements will now be available across indications, for use in situations where there is high clinical or financial uncertainty to inform cost-effectiveness estimates and there is plausible potential for a drug to satisfy the criteria for routine commissioning.

D. Budget Impact Schemes

In cases where potential net budget impact is expected to exceed £20 million per year in any of the first 3 years of a technology’s use in the NHS, NHS England will open commercial discussions with the company. In cases where an agreement is not made, NHS England may request a variation to the statutory funding requirement. During discussions, NHS England will consider both the overall cost to the NHS and any likely direct competition or external impact to the market that may mitigate any spend by the NHS.

Considerations for manufacturers

The overview of potential commercial arrangements available outlined by NHS England demonstrates an increased flexibility in NHS England’s approach to discussing pricing and contracting with manufacturers. Whilst only a few examples of confidential commercial agreements are noted in the framework (e.g. price-volume agreements), NHS England have noted that in practice, there are currently around 20 types of various commercial agreements in place. In addition, the various commercial options should not be seen as mutually exclusive. For example, it is possible for a company to have in place both a simple discount and a complex commercial agreement with NHS England.

For companies who believe commercial agreements may be of importance for their situation, it is important to have early engagement with NHS England. As such, NHS England have set up commercial surgeries to enable such interactions. These engagement meetings usually take place prior to a NICE appraisal and provide opportunity for in-depth discussions on commercial issues. If relevant, NHS England may invite NICE to such discussions. Discussions with NHS England may also occur after the publication of a NICE appraisal, for instance in the case of uncertainty, where there is plausible potential for a managed access agreement to be of benefit.

The expansion of managed access agreements as a potential option for all therapeutic areas will create significant opportunities in areas such as rare diseases, where manufacturers may not have been able to implement sufficiently robust clinical trials. During engagement workshops, NHS England have noted that reappraisals following managed access agreements have the potential to lead to a price decrease or increase, depending on the clinical value demonstrated. Although aggregated data on this is not yet publicly available (and may not be in the near future), Blake Dark (NHS England Commercial Medicines Director) has stated that some products exiting the CDF have been able to achieve such price increases.

Whilst this move from NHS England towards increased flexibility and engagement with industry is favourable, it is important for manufacturers to be aware that the preferred commercial arrangement for NHS England will always be simple discounts. Transactability of arrangements is a key consideration for the NHS and commercial arrangements which require additional time and resource from healthcare professionals (e.g. via additional patient monitoring or data collection) are not looked upon favourably and can, in some cases, hinder product uptake. Nevertheless, Dark also stressed that the UK’s unique “cradle-to-grave” healthcare system offers manufacturers a wealth of opportunity for data collection. The most feasible managed access agreements are likely to be those which utilise existing UK data collection systems in order to generate real world evidence.

Manufacturers should also be aware that whilst the Framework has stated an openness for discussions in cases where indication expansion results in commercial challenges, Dark and his team have stressed that multi-indication pricing is not something that NHS England are likely to pursue. The type of commercial flexibility referred to in this situation within the Framework is vague and likely to vary on a case-by-case basis.

Overall, the draft Commercial Framework highlights a move from NHS England to increase commercial flexibility. However, the preferred agreements will remain to be simple discounts enabling confidential net prices, whilst maintaining target list prices (and therefore minimising international reference pricing implications). As reiterated by NHS England within the document, engaging with relevant stakeholders early on in the product lifecycle is likely to help ensure enough time is available to develop the right pricing and market access strategy and successfully implement commercial arrangements. For manufacturers who believe that managed access agreements in particular may be a potential option for them in the future, we recommend ensuring cross-functional teams (including medical, health economics and outcomes research (HEOR), market access etc.) have an understanding of real world evidence and how this can be leveraged within managed access agreements.