EUnetHTA and the EU Joint HTA Process

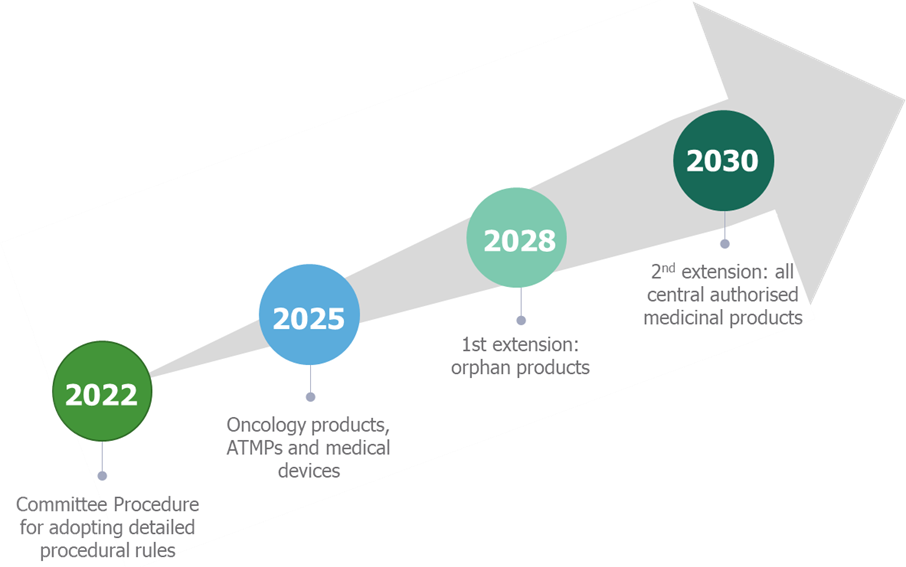

EUnetHTA was established in 2006 to facilitate information sharing between health technology assessment (HTA) agencies across the European Union (EU). Since then, there has been pressure to create a unified HTA process within the EU. The EUnetHTA21 workstream aims to establish an EU-wide joint assessment of clinical effectiveness, with an accompanying process for joint early scientific with EU HTA agencies1. This vision is coming closer to being realised, with the implementation of the EU joint HTA process beginning in 2025 for oncology products, 2028 for orphan products and 2030 for all other centrally authorised medicinal products (Figure 1)2. As many manufacturers will already have products in their pipelines which may go through a joint clinical HTA, this article will consider what manufactures should be doing now to prepare for their submission. More detailed discussions about other topics relating to EUnetHTA can be found here, in our EUnetHTA series.

Market access planning needs to start at the EMA submission

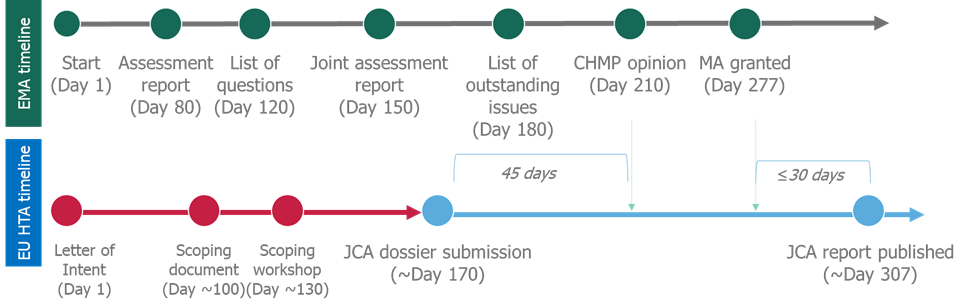

Currently, national HTA submissions begin following CHMP opinion by the EMA, meaning that there is only a small amount of overlap between the regulatory submission and the HTA submission. EUnetHTA has released key procedural milestones for the EUnetHTA3 assessment and though there may be some divergence depending on the regulatory pathway, clinical assessment dossiers will have to be submitted earlier.

It is proposed that the joint clinical assessment (JCA) dossier will have to be submitted 1 month prior to the CMHP opinion (Figure 2)3. Counting back, through the stages that are required prior to submission, it means that market access activities will need to start at the same time as EMA submission (Figure 2).

What could this mean for manufacturers?

- Market access activities will need to be started earlier to ensure that manufacturers are prepared for the submission of regulatory and JCA submission at the same time.

- Resources will have to be stretched or additional investments made to ensure that there is the bandwidth to cover both processes, which may be a struggle for smaller companies.

- As the JCA report is set to be published just 30 days after the CHMP decision, national procedures to begin pricing negotiations could start very rapidly.

Differences and similarities between European and country endpoints and developing contingency strategies

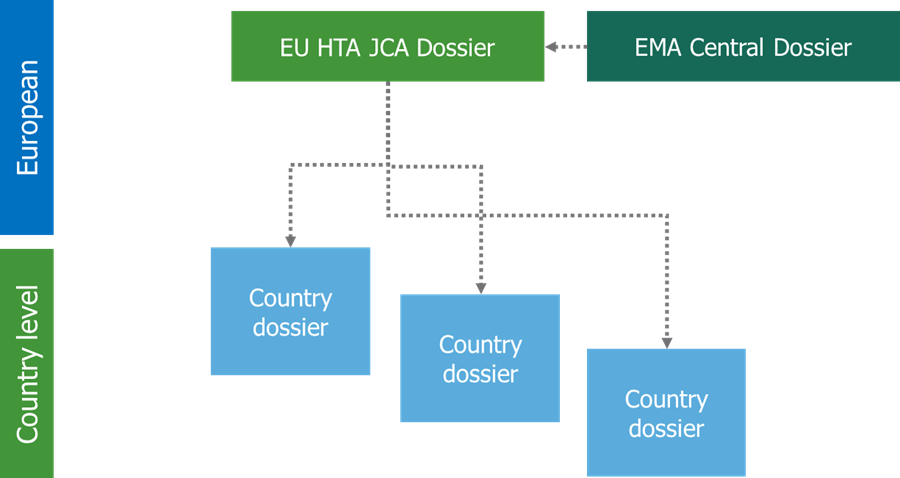

The results of the JCA will be non-binding and each member state will have independence on how to use the outcomes of the assessment. Different national HTA bodies have considerable divergence between one another and likely have divergence between what is required for the future JCA. Consequently, we can expect that some countries will ask for additional data and evidence (Figure 3)4. Therefore, it will be crucial to understand what additional data collection and analysis will be required at the country level and by which countries.

If some counties require additional evidence, it could potentially change the European pharmaceutical landscape as the launch sequence of EU countries is affected based on the speed to market following the JCA. We assume that EU countries who do not currently have traditional HTA assessments, like the Baltic states, will begin price negotiations largely based on the JCA which may lead to more rapid market access. We anticipate that though some countries will use the clinical assessment, they will need a more in-depth pricing and economic assessment such as in Portugal, Austria, or the Netherlands. Whereas others may require additional clinical analysis on top of pricing and economic assessment after the JCA, such as in France, Germany, and Spain, which could delay the access of drugs in these countries in comparison to other EU countries.

What could this mean for manufacturers?

- Manufacturers will have to anticipate what additional data may be required for additional country specific dossiers

- Duplication of work as there may be overlap in the requirements of the JCA dossier and the country level dossiers.

- There could be rapid access in countries who base their pricing/access negotiations largely on the JCA which could have a knock-on effect on launch strategy and international reference pricing.

- There may be variable pricing and access outcomes as country level dossiers will use different methodologies.

2.5 years to go before this is realised- get going now, don’t delay

The vision of joint clinical assessment is close to being realised. Manufacturers with oncology products, ATMPs or orphan drugs in the pipeline must start to think about how they will gain access in Europe. To help with this, EUnetHTA are also providing Joint Scientific Consultations, which is non-binding scientific advice to occur before the start of pivotal clinical trials to aid in improving the quality and appropriateness of the data produced. This opportunity should be seized by manufacturers as the process is new and could provide advice on clinical trial design, choice of comparators, endpoints, patient populations and so on5.

What could this mean for manufacturers?

- Start considering now what comparators, endpoints, and subpopulations a JCA may require when planning clinical trials to avoid additional work later.

- But also consider country divergences so that data can be prepared for the local submissions that will likely follow the JCA.

In conclusion

Until an update is given for what will need to be provided by manufacturers for the JCA there is still uncertainty about what preparations manufacturers can make. Though this initiative aims to reduce duplication of work for the 27 EU member states, it is likely, at least in the early phases of JCAs, that manufacturers may still be required to duplicate work to satisfy every country. However, we can assume that there may be some significant changes to the pharmaceutical market in Europe due to EUnetHTA. There are several actions that pharmaceutical companies could make to try and mitigate this uncertainty and be best prepared for the onset of JCAs. As this process is new, companies should exploit access to the joint scientific consultations to try to ensure that their clinical trials are up to scratch for the JCA but should also try to anticipate any additional data that may be needed on a country level. Additionally, manufacturers should plan early to ensure they have the resources to support a tandem regulatory and JCA submission.

Sources:

- About EUnetHTA21. EUnetHTA. https://www.eunethta.eu/about-eunethta/. Accessed 20th May 2022.

- EUnetHTA 21 – Stakeholder Kick Off Meeting. EUnetHTA. https://www.eunethta.eu/wp-content/uploads/2021/12/EUnetHTA-21-Stakeholder-Meeting-03.12.-FOR-WEBSITE.pdf. Accessed 8th June 2022.

- Submission FAQs for Industry – Pharmaceuticals. EUnetHTA. https://www.eunethta.eu/frequently-asked-questions-for-the-pharmaceutical-industry/. Accessed 8th June 2022.

- EU HTA & EUnetHTA21 – The pathway for implementation of the EU HTA system in 2025 – helping companies prepare for submission. EUCOPE. https://www.eucope.org/events/eu-hta-eunethta21-the-pathway-for-implementation-of-the-eu-hta-system-in-2025-helping-companies-prepare-for-submission/. Accessed 9th June 2022.

- Joint Scientific Consultations (JSC). EUnetHTA. https://www.eunethta.eu/jsc/#:~:text=Parallel%20EMA%2FEUnetHTA%2021%20Joint%20Scientific%20Consultations%20(JSCs)%20provide,of%20future%20HTA%20assessment%20%2F%20re%2D. Accessed 9th June 2022.