Introduction

Cell and gene therapies represent an exciting new frontier in medicine that could fundamentally revolutionise how we prevent, treat and potentially cure many severe, debilitating diseases.

While still in the relatively early stages of development and commercialisation, cell and gene therapies have already demonstrated remarkable results in small trials across cancer, genetic disorders, neurodegenerative diseases, and other conditions that have been very difficult to treat with traditional small molecule pharmaceuticals or biologics1. However, there are still very significant market access challenges that need to be urgently addressed before these cutting-edge treatments can be made widely accessible to patients globally who stand to benefit.

Some pioneering biopharmaceutical companies are continuing to invest heavily in cell and gene therapies, placing big bets on their potential, while others have scaled back their efforts due to the complex difficulties of commercialisation at scale and price optimisation2.

Key players in the field

Novartis are one of the several leading drug manufacturers to make cell and gene therapies a high priority, dedicating billions in R&D spending to these new platforms which they view as the future of medicine. The company claim to be leaders in the space, with regulatory success around the world3. They also boast various positive recommendations from health technology assessments (HTA)s, for example, NICE have recommended their gene-therapy for spinal muscular atrophy, Zolgensma4, and a CAR T-cell immunotherapy for B-cell acute lymphoblastic leukemia, Kymriah5. Novartis are ploughing ahead with development programs across numerous disease targets including major investments in next-generation CRISPR gene editing, patient-derived induced pluripotent stem cell technology and advanced manufacturing to continue advancing the field3.

AstraZeneca has also made very significant R&D investments, developing a pipeline of cell therapies for cancer as well as other major diseases like heart failure, diabetes, and kidney disease. The company aim to apply CRISPR gene editing, Treg cell (regulatory T cell) stabilising and stem cell engineering to make these treatments more effective, precise, and scalable. AstraZeneca’s CEO has expressed, “AstraZeneca believes that cell therapy has the potential to cure many diseases that are currently untreatable”6,7.

Set backs and pull-outs

Other firms are taking a more cautious approach, having been sobered by early setbacks and slower than expected development of cell and gene therapies beyond small trials. GSK, an early pioneer in gene therapy, faced commercial struggles in Europe with Strimvelis, the first approved gene therapy for adenosine deaminase deficient severe combined immunodeficiency, which they priced at $648K8. GSK received European marketing authorisation for this product in 2016 but then transferred it to Orchard Therapeutics in 2018. This handover occurred through a strategic agreement under which GSK gained 19.9% equity stake in Orchard Therapeutics and a seat on the board in return for the transfer of its portfolio of approved and investigational rare disease gene therapies9. Then, in July 2023, the European Commission approved the transfer of marketing authorisation of Strimvelis from Orchard Therapeutics to the biomedical charity Fondazione Telethon, who are the first non-profit organisation to take on the commercialisation of a gene therapy. Fondazione Telethon will continue to make Strimvelis available, however only eligible patients of the San Raffaele Hospital in Milan, Italy, will have access, currently10.

Citing persistent manufacturing constraints, GSK has also recently scrapped the UK launch of its approved antibody-drug conjugate Blenrep for multiple myeloma11, dimming short-term hopes of a full European rollout. Then GSK announced that it is pulling out of cell therapy altogether. The company cited several reasons for its decision, including the high cost of development and the long time it takes to bring cell therapies to market. GSK also noted that the success rate of cell therapies has been mixed, with some treatments failing to live up to expectations12.

Johnson & Johnson and partner Legend Biotech have faced similar production challenges to GSK, noting the complexities of scaling up specialised manufacturing capabilities for each new CAR-T product. These supply chain difficulties reflect the broader complications of commercialising cell and gene treatments beyond small trials. Transforming small batch-based lab procedures into mass production is enormously complex, time-consuming and resource intensive. Despite this, Carvykti, a CAR-T therapy for multiple myeloma with a price tag of $465 thousand, generated $117 million in the second-quarter sales, up from $72 million in the first three months of the year. The increase suggests success in the combined effort of Johnson & Johnson and partner Legend Biotech to increase the supply of Carvykti13.

Another company that has faced setbacks is Bluebird bio. Their gene therapy for the inherited neurological disorder cerebral adrenoleukodystrophy, Skysona, was approved by European regulators in July 2021, but only one month later, they announced a ceasing of operations in Europe. This retreat was driven by Bluebird’s ongoing difficulties in securing reimbursement agreements in Europe for its high-priced gene therapies. Previously in 2019, Bluebird withdrew Zynteglo, a $1.8 million gene therapy for severe beta thalassemia, from Germany, after failing to win coverage from authorities there. The European reimbursement challenges have led Bluebird to narrow its focus to the US market where coverage prospects are better for its gene therapies like Skysona and Zynteglo. Skysona has a price tag of $3 million, placing it as the most expensive therapy in the world until last year with the emergence of CSL Behring’s hemophilia B gene therapy Hemgenix at $3.5 million14,15,16.

How are the challenges being addressed?

Despite promising progress, there are still critical challenges that need to be addressed before cell and gene therapies can fully deliver. As mentioned, manufacturing and supply chain issues continue to cause problems. The current model of centralised manufacturing limits patient access and makes quality control difficult. Production costs are extremely high, and capacity is scarce, forcing companies to make hard choices on which therapies to prioritise. Some have suggested shifting to automated decentralised manufacturing networks could improve scalability and reduce costs over time. Øystein Åmellem, PhD, director of cell therapy at Thermo Fisher Scientific says, “Today, decentralisation of cell and gene therapy is emerging as a response to the high cost of such therapies, but also to reduce logistical complexity, risk, and time that ultimately will give patients and their families better healthcare”17.

There are also concerns that the field remains too focussed on advanced economies, slowing progress. Some argue that collaboration with developing countries could widen the pool of eligible patients for clinical trials, accelerating R&D. Patients in lower income regions stand to benefit the most from access to these potential cures, for example, the highest rates of sickle cell disease are in Africa18.

There are still risks associated with modifying human genes and cells that require careful monitoring. Targeted gene editing tools like CRISPR have raised concerns about making permanent, heritable changes to DNA19. Long-term safety surveillance systems will need to be enhanced as more patients are treated. Scientific progress will also have to be balanced against complex ethical considerations regarding how this technology is used. Finally, even if these therapies are successfully approved, questions remain around how to make them accessible to all patients who could benefit. With price tags frequently in the millions, national health services will struggle to provide these treatments within constrained budgets. New financial models are urgently needed to align incentives and distribute costs over time. Otherwise, cell and gene therapy may remain restricted to wealthy nations and individuals, exacerbating global healthcare inequality.

Progress and promise ahead

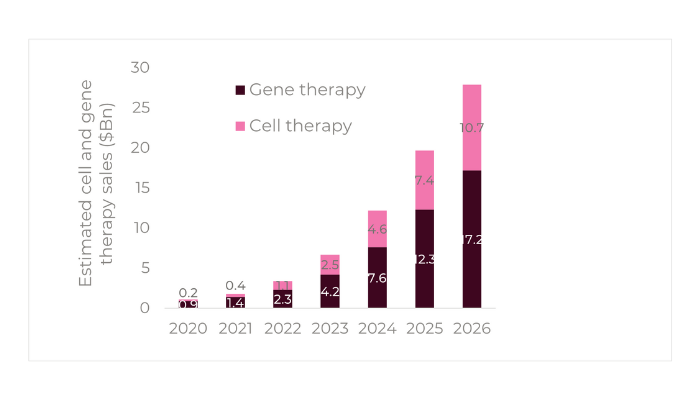

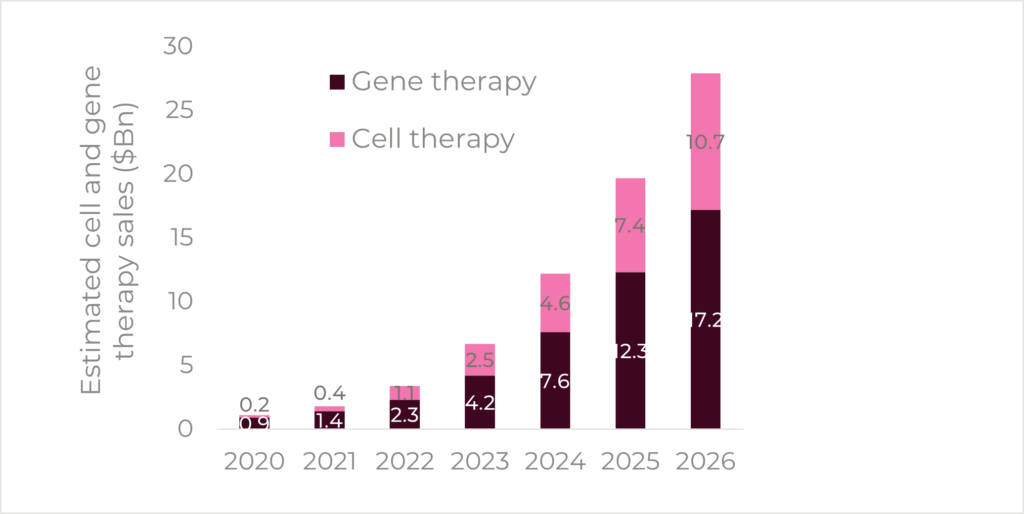

The prospects for cell and gene therapies overall appear very bright, with the market forecasted to reach approximately $17.2Bn and $10.7Bn respectively by 2026 (Figure 1)20. According to Timothy Hunt, CEO of the Alliance for Regenerative Medicine, 13 new cell or gene therapies could be approved in 2023 by the FDA and EMA, by the end of the year1.

There is growing momentum behind companies utilising CRISPR gene editing to develop more precise and versatile therapies. The first ever in-human CRISPR-based therapy, developed by Intellia Therapeutics and Regeneron Pharmaceuticals, could potentially arrive soon for the treatment of transthyretin amyloidosis21. This landmark approval would pave the way for many other CRISPR therapies in the pipeline. Beyond rare diseases, possible approvals for gene therapies for more common conditions like hemophilia22 and Duchenne muscular dystrophy23 would address substantial unmet needs and might accelerate broader adoption.

Major progress has also been made recently in tackling key safety concerns and delivery challenges that previously hindered the field. For example, innovative techniques using patient-derived induced pluripotent stem cells could reduce or eliminate the need for immunosuppressants and chemotherapy in regenerative medicine, lowering toxicity risks24. Meanwhile, advances in viral vector engineering, and delivery materials like liquid nanoparticles are also yielding more precise, stable and potent therapies25.

On the crucial policy front, regulatory agencies like the EMA and FDA have been actively working to smooth and accelerate the approval path for cell and gene therapies, realising the urgent need for adaptive frameworks that encourage responsible innovation26. The recent comprehensive regenerative medicine legislation passed in Japan demonstrates how progressive laws, incentives and coordinated national investment can foster growth of the industry27. Governments globally should continue to implement adaptive, accelerated pathways while ensuring patient safety remains paramount.

Insurers, policy think tanks and healthcare systems around the world are also experimenting with innovative models to fund and reimburse potentially curative therapies in a way that is sustainable over the long term. There is increased enthusiasm for progressive instalment payment plans, annuities, pay for performance arrangements and outcomes-based rebates28. With continued constructive multi-stakeholder dialogue and pragmatic policy evolution, equitable access to cell and gene therapies could become a reality across more communities. Despite this, with the access challenges such as those faced by GSK, Johnson & Johnson and Bluebird bio, it remains to be seen whether healthcare systems and payers will be able to adapt to these innovative technologies and enable their benefits to be fully achieved.

Conclusion

In summary, cell and gene therapies offer immense hope to patients suffering from debilitating diseases without adequate treatment options and have the potential to alter the trajectory of medicine if key challenges can be progressively overcome. But the incredible scientific promise of these platforms must be matched by commercial viability, manufacturing scale-up and equitable global access for the field to live up to its potential.

Ongoing private-public partnerships, international collaboration, and adaptive, forward-looking policies will be instrumental to delivering these cutting-edge treatments to the patients around the world who need them most. If critical issues around infrastructure, supply chain bottlenecks, long-term funding and global distribution are creatively addressed, cell and gene therapy may well represent the next great leap forward in medicine and provide therapies that don’t just alleviate but permanently cure complex, devastating diseases.

Sources:

1. Hunt T. The cell and gene therapy sector in 2023: A wave is coming – are we ready? In Vivo. Jan 2023

2. What is cell and gene therapy – Novartis. Available at: https://www.novartis.com/about/innovative-medicines/novartis-pharmaceuticals/novartis-gene-therapies/what-cell-and-gene-therapy (Accessed: 11 September 2023)

3. The Pioneers of CAR-T Cell and Gene Therapy – Novartis. Available at: https://www.novartis.com/research-development/technology-platforms/cell-therapy/car-t-cell-therapy-and-beyond/car-t-healthcare-professionals/pioneers-car-t-cell-and-gene-therapy (Accessed: 12 September 2023)

4. NICE recommends cutting-edge therapy for young people with blood cancer. Available at: https://www.nice.org.uk/news/article/nice-recommends-cutting-edge-therapy-for-young-people-with-blood-cancer (Accessed: 20 September 2023)

5. NHS England strikes deal on life-saving gene-therapy drug that can help babies with rare genetic disease move and walk. Available at: https://www.england.nhs.uk/2021/03/nhs-england-strikes-deal-on-life-saving-gene-therapy-drug-that-can-help-babies-with-rare-genetic-disease-move-and-walk/ (Accessed: 20 September 2023)

6. Harnessing the power of cell therapy – AstraZeneca. Available at: https://www.astrazeneca.com/r-d/next-generation-therapeutics/cell-therapies.html (Accessed: 11 September 2023)

7. Targeting the drivers of disease with gene therapy – AstraZeneca. https://www.astrazeneca.com/r-d/next-generation-therapeutics/gene-therapy.html (Accessed 13 September 2023)

8. StrimvelisTM receives European marketing authorisation to treat very rare disease, ADA-SCID. Available at: https://www.gsk.com/en-gb/media/press-releases/strimvelistm-receives-european-marketing-authorisation-to-treat-very-rare-disease-ada-scid/ (Accessed 20 September 2023)

9. GSK signs strategic agreement to transfer rare disease gene therapy portfolio to Orchard Therapeutics. Available at: https://www.gsk.com/en-gb/media/press-releases/gsk-signs-strategic-agreement-to-transfer-rare-disease-gene-therapy-portfolio-to-orchard-therapeutics/ (Accessed 20 September 2023)

10. Fondazione Telethon and Orchard Therapeutics complete transfer of marketing authorization of Strimvelis for ADA-SCID in Europe. Available at: https://www.telethon.it/en/stories-and-news/news/from-telethon-foundation/fondazione-telethon-orchard-therapeutics-complete-transfer-marketing-authorization-strimvelis-for-ada-scid-europe/

11. GSK provides an update on Blenrep (belantamab mafodotin-blmf) US marketing authorisation. GSK Press releases. Nov 2022

12. Waldron J. ‘It’s the right call’: GSK expresses no regrets on abandoning cell therapy as oligo strategy heats up. Fierce Biotech. Feb 2023

13. Liu A. Johnson & Johnson Shelves Carvykti’s UK launch amid manufacturing shortfalls. Fierce Pharma. Mar 2023

14. Pagliarulo N. Bluebird, winding down in Europe, withdraws another rare disease gene therapy. BioPharma Dive. Oct 2021

15. Liu A. A $3M gene therapy: Bluebird bio breaks its own pricing record with FDA approval of Skysona. Fierce Pharma. Sep 2022

16. Castronuovo C. World’s Most Expensive Drug Revives Push for New Payment Models. Bloomberg Law. Jan 2023

17. Decentralizing the Manufacturing of Cell and Gene Therapies. Available at: https://www.genengnews.com/topics/decentralizing-the-manufacturing-of-cell-and-gene-therapies. (Accessed 10 September 2023)

18. Cornetta K, Patel K, Wanjiku CM, Busakhala N. Equitable Access to Gene Therapy: A Call to Action for the American Society of Gene and Cell Therapy. Mol Ther. 2018;26(12):2715-2716. doi: 10.1016/j.ymthe.2018.11.002

19. Sharma, S. Can the world keep the lid on the pandora’s box of gene editing? Available at: https://carnegieendowment.org/2019/04/09/can-world-keep-lid-on-pandora-s-box-of-gene-editing-pub-78798 (Accessed: 12 September 2023).

20. M Buente, M Hosseini, T Kaltenbach. Cell and gene therapies: Pharma’s next big wave. Roland Berger. May 2021

21. Kaiser J. ‘First gene-editing treatment injected into the blood reduces toxic protein for up to 1 Year’. Science. doi:10.1126/science.adb1748. Mar 2022

22. Chen H, Shi M, Gilam A. et al. Hemophilia A ameliorated in mice by CRISPR-based in vivo genome editing of human Factor VIII. Sci Rep. 2019;9, 16838. https://doi.org/10.1038/s41598-019-53198-y

23. Erkut E, Yokota T. CRISPR Therapeutics for Duchenne Muscular Dystrophy. Int J Mol Sci. 2022;23(3):1832. doi: 10.3390/ijms23031832

24. Paik DT, Chandy M, Wu JC. Patient and Disease-Specific Induced Pluripotent Stem Cells for Discovery of Personalized Cardiovascular Drugs and Therapeutics. Pharmacol Rev. 2020;72(1):320-342. doi: 10.1124/pr.116.013003

25. Sinclair F, Begum AA, Dai CC. et al. Recent advances in the delivery and applications of nonviral CRISPR/Cas9 gene editing. Drug Deliv. and Transl. Res. 2013;13, 1500–1519

26. Demand Exceeds Supply in Cell & Gene Therapy Workforce. Available at: https://www.absorption.com/demand-exceeds-supply-in-cell-gene-therapy-workforce. (Accessed 15 September 2023)

27. Ishii T. Raising Gene Therapy for Unmet Medical Needs in Japan. JMA J. 2019;2(1):73-79. doi: 10.31662/jmaj.2018-0040

28. The moment of truth for healthcare spending: How payment models can transform healthcare systems. World Economic Forum. Available at: https://www.weforum.org/reports/the-moment-of-truth-for-healthcare-spending-how-payment-models-can-transform-healthcare-systems (Accessed: 12 September 2023)