Introduction to orphan drug prices and market share

Orphan drugs are designated as they are used to treat very rare diseases with a small patient population or where the medicine is unlikely to generate sufficient profit to justify R&D costs. However, their introduction to the market is the key driver of the overall spending growth on drugs and sets significant financial challenges for healthcare systems. Payers must balance the increased costs of orphan drugs with the potential benefit to a small cohort of often seriously ill patients. The worldwide sales of orphan drugs are expected to reach $217 billion by 2024 and could account for 18% of total prescription drug sales.1,2. However, there are significant differences between the US and Europe. This article looks to understand the level of difference and explore the underlying reasons why.

What is the extent of the differences between the US and Europe?

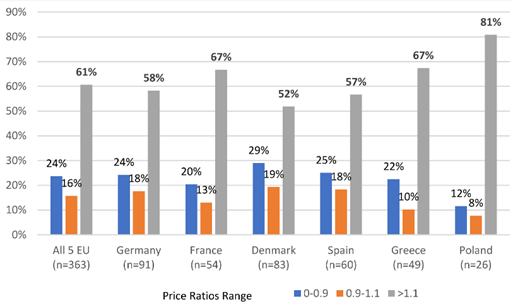

From launch until loss of orphan status analysis suggests that prices of orphan drugs in the US are on average 1.64 times higher than for the same drugs in Europe (figure 1).3 Additionally, approximately 3 years post-launch, the price differential tends towards higher US prices.3. For example, in 2019 the price ratio between the US and UK for the multiple myeloma drug Pomalyst/Imnovid was 1.4 in favour of the US, however, as of the 4th September 2023 this sits at 2.3 ($25,968.41 in the US vs $11,217.83 in the UK).4-6.

Is there a difference between single use and chronic treatments?

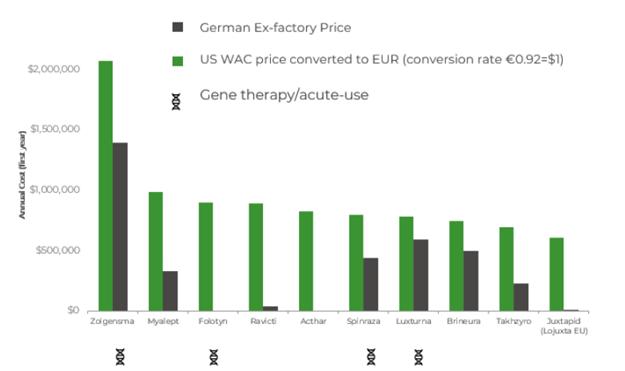

Acute treatments tend to have greater expense up front over chronic treatments. However, as they are single use and if they are curative, or dramatically improve patient outcomes, over a patient’s lifetime they can be considered good value for money for a healthcare provider. For example, the most expensive treatment in the world, Zolgensma (Figure 2), has a US WAC (ex-factory) price of $1.9 million. When assessed over a patient’s lifetime, the annual cost is actually roughly equal to Spinraza (a chronic alternative and has a price point ten times lower than for Zolgensma).

Acute and chronic treatments show further nuances on price between the US and Europe. When comparing the treatment costs for chronic and acute therapies the differences between Germany and the US follows the usual trend of prices being much higher in the US. However, when looking at the lifetime costs, the difference is far less pronounced for single-use treatments. The average lifetime costs of the most expensive chronic treatments are $14.7 million and $2.8 million for the US and Germany respectively (ratio of 5.3), whereas for acute treatments the average lifetime costs are $1.4 million (US) and $763K (DE) at a ratio of 1.8. 7

Why are orphan drug prices higher in the US compared to Europe?

When comparing the difference in price between the US and Europe for orphan and non-orphan drugs, the relative differences in price are comparable. This indicates that the likely reasons for higher US prices are common across both orphan and non-orphan treatments. The most important piece of the puzzle is likely the presence of Health Technology Assessments in Europe. In the US there is no national assessment framework, instead relying on free pricing and negotiations between healthcare insurers and manufacturers. This can often result in varying prices for the same drug.

However, the Institute for Clinical and Economic Review (ICER) recently published a white paper in 2022 that evaluated potential reforms to orphan drug pricing and coverage in the US and put forward options such as expanding outcomes based contracts, indication based pricing, value based pricing and volume based contracts, all aimed at reducing orphan drug prices.11

In the major European markets, price negotiations take place based on the extent of additional benefit to patients and/or the outputs of health economic assessments. Additionally, there is more aggressive management of orphan drug prices by pricing and reimbursement authorities in the EU compared to the US. For example, in Germany there is a sales threshold of €30 million, whereby if a products’ annual revenue exceeds this it will be subject to the full AMNOG (Health Technology Assessment) process.8

Demonstrating the cost or clinical effectiveness of an orphan drug during a Health Technology Assessment is also a challenge, due to the common trial limitations for orphan drugs (e.g. single-arm trial)9. This difficulty in demonstrating sufficient benefit was shown to prove too much of an impasse when BlueBird Bio was launching their gene-therapy Zynteglo, where the data on durability of the treatment was deemed not yet mature. Negotiations eventually broke down and BlueBird Bio decided that it would begin winding down its operations in Europe, citing “challenges of achieving appropriate value recognition and market access in Europe”.10

Conclusion

In conclusion, orphan drug prices are much higher in the US than for the corresponding products marketed in Europe, largely due to the additional HTA barrier in Europe and more stringent cost-containment measures. This is unlikely to change any time soon unless there are changes to the scope of the Inflation Reduction Act (IRA), which currently exempts orphan drugs with a single indication, or other price control mechanisms.12 For more information orphan medicine market access in Europe and the growing challenges ahead in our upcoming webinar on the 28th September, find out more about this on our website.

Sources:

1. Research and Markets. Global Orphan Drug Report 2020-2024: Over 7,600 Orphan Drug Designations Covered Across the $217 Billion Market. Accessed 03/09/2023, https://www.prnewswire.com/news-releases/global-orphan-drug-report-2020-2024-over-7-600-orphan-drug-designations-covered-across-the-217-billion-market-301369022.html

2. Villa F, Filippo A, Pierantozzi A, et al. Orphan Drug Prices and Epidemiology of Rare Diseases: A Cross-Sectional Study in Italy in the Years 2014–2019. Frontiers in Medicine. 2022;9doi:10.3389/fmed.2022.820757

3. Zelewski P, Wojna M, Sygit K, Cipora E, Gaska I. Comparison of US and EU Prices for Orphan Drugs in the Perspective of the Considered US Orphan Drugs Act Modifications and Discussed Price-Regulation Mechanisms Adjustments in US and European Union. International Journal of Environmental Research and Public Health. 2022;19(19)doi:10.3390/ijerph191912098

4. Micromedex. Redbook. Accessed 04/09/2023, https://www.micromedexsolutions.com/micromedex2/librarian/CS/E8DB86/ND_PR/evidencexpert/ND_P/evidencexpert/DUPLICATIONSHIELDSYNC/3B1933/ND_PG/evidencexpert/ND_B/evidencexpert/ND_AppProduct/evidencexpert/ND_T/evidencexpert/PFActionId/redbook.FindRedBook?navitem=topRedBook&isToolPage=true

5. National Institute of Health and Care Excellence. British National Formulary. Accessed 04/09/23, https://bnf.nice.org.uk/

6. Kang S-Y, DiStefano M, Socal M, Anderson G. Using external reference pricing In medicare part D to reduce drug price differentials with other countries. Pharmaceuticals and Medical Technology. 2019;38(5)doi:10.1377/hlthaff.2018.05207

7. Remap Consulting. Are acute therapies and curative drugs more affordable than chronic treatments in rare diseases? Accessed 04/09/2023, https://remapconsulting.com/orphan-drugs/are-acute-therapies-and-curative-drugs-more-affordable-than-chronic-treatments-in-rare-diseases/

8. Koyuncu A, Herold S. Inside EU Life Sciences: Updates on Legal Developments in the EU Life Sciences Industry Accessed 06/09/2023, https://www.insideeulifesciences.com/2022/10/26/germany-significantly-tightens-drug-pricing-and-reimbursement-laws/

9. Onakpoya I, Spencer E, Thompson M, Heneghan C. Effectiveness, safety and costs of orphan drugs: an evidence-based review. BMJ Open. 2015;5(6)doi:10.1136/bmjopen-2014-007199

10. Mitchell G. Zynteglo highlights stark differences between EU and US markets Accessed 06/09/2023, https://www.lcp.com/our-viewpoint/2022/10/zynteglo-highlights-stark-differences-between-eu-and-us-markets/

11. Institute for Economic Review. The Next Generation of Rare Disease Drug Policy: Ensuring Both Innovation and Affordability 2022. https://icer.org/wp-content/uploads/2022/04/ICER-White-Paper_The-Next-Generation-of-Rare-Disease-Drug-Policy_040722.pdf

12. Chambers J, Clifford K, Enright D, Neumann P. Follow-On Indications for Orphan Drugs Related to the Inflation Reduction Act. Health Policy. 2023;6(8)doi:10.1001/jamanetworkopen.2023.29006