An analysis of the top 10 most expensive drugs in the US compared with Germany.

Introduction and Objectives

- In recent years there has been focus on acute treatments being ‘the most expensive drugs in the world’. In 2019, we compared the costs of the most expensive gene/acute therapies and chronic treatments for rare diseases in the US on an annual and lifetime basis to contrast short- and long-term costs.

- Overall, that research suggested that acute and curative drugs may in fact be more affordable than chronic treatments over a patient’s lifetime.

- This is an updated analysis to identify any changes since 2019. The aims of this study are to compare the annual and lifetime treatment costs of the 10 most expensive drugs in the US; and secondly to compare these costs between the US and Germany.

- A comparative analysis with Germany was chosen as Germany is considered to have the highest cost drugs compared to other European countries1

Methods

A targeted approach was used to assess the most expensive drugs on an annual cost basis.

- A literature review of PubMed and grey databases was conducted. This included the following search terms: high cost, most expensive treatment, therapy, annual, lifetime.

- The most expensive 25 drugs were assessed, and prices (USD WAC price and EUR APU price) and dosing data were identified and analyzed to calculate annual treatment costs. Age of onset and life-expectancy data per indication were also used to estimate lifetime treatment costs.

- The top 10 most expensive products on an annual treatment basis were selected based on US WAC price.

- The annual and lifetime cost of the top 10 most expensive products between US and Germany was compared.

Results

- The assessment showed that the top 10 most expensive drugs are a combination of gene therapies and chronic-use treatments, compared with 2019 where the top 10 were all gene therapies offering patients a ‘cure’ or ‘life-prolonging’ impact.

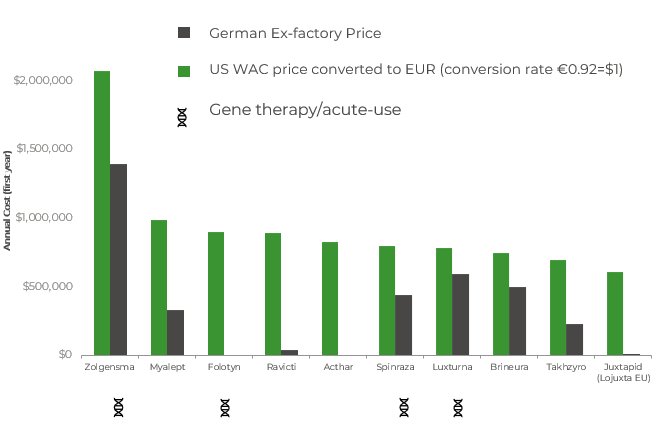

- Of the top 10 most costly treatments, 3 acute treatments (Zolgensma, Luxterna, Folotyn) remain with the new addition of Spinraza since 2019 (Chart 1).

- Zolgensma has the highest annual treatment costs. The remaining 6 treatments are all used chronically. The acute therapy, Folotyn, and chronic treatment, Acthar are not approved by the EMA.

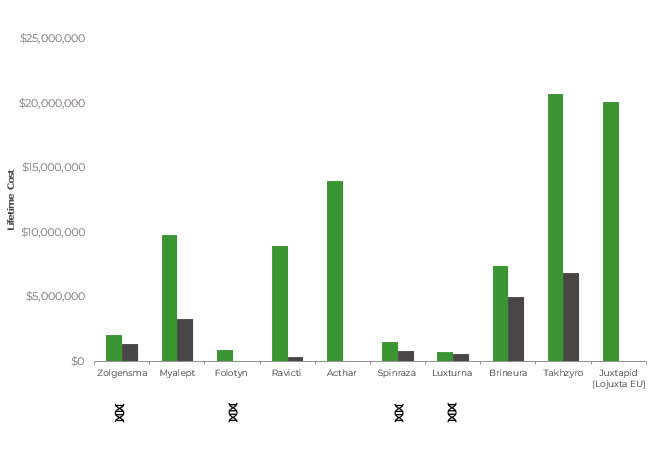

- Interestingly, considering the lifetime costs of these top 10 (most costly, annual) products, based on US ex-factory price, the acute treatments are ranked #7-10 (Chart 2). Based on German ex-factory price the highest rank is #4 for Zolgensma. The other acute treatments rank #5,6,10.

- Takhzyro, a chronic treatment, is ranked at #1 in both the US and Germany on a lifetime basis.

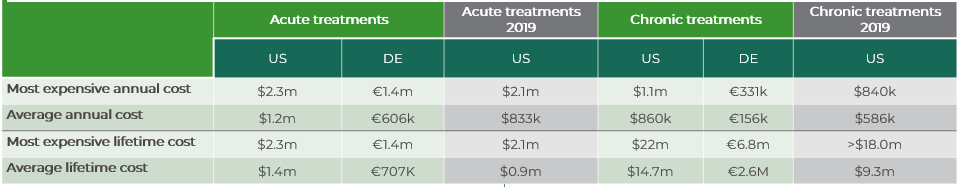

- The average annual (first year) ex-factory price for the acute treatments remains higher than for the chronic treatments (Table 1). The average lifetime costs of the six drugs used chronically is far higher than the lifetime cost of the acute therapies with an average of $14.7m/€2.6m compared to just $1.4m/€707k for acute treatments

- Furthermore, the ex-factory price across annual and lifetime costs of the top 10 most expensive drugs has increased since 2019. The costs of these drugs are generally far higher in the US than in Germany, even when you take into consideration the conversion rate as demonstrated in Chart 1 and Chart 2.

Chart 1: Annual cost of the 10 most expensive drugs in the US compared to Germany (based on ex-factory price in EUR)

Chart 2: Lifetime cost of the 10 most expensive drugs in the US compared to Germany (based on ex-factory price in EUR)

Table 1: Comparison of annual and lifetime costs of the 10 most expensive drugs globally, based on ex-factory price

Conclusion

- Overall the research continues to suggest that acute and curative drugs may in fact be more affordable than chronic treatments over a patient’s lifetime.

- Existing pricing models tend to focus on short-term affordability, a significant challenge for payers and manufacturers when it comes to evaluating gene-therapies with uncertain clinical data. Innovative assessment frameworks need to focus on the long-term game, taking into consideration comparative lifetime costs and overall budget impact to assist payer decision-making and mitigate concerns relating to high ‘one-off’ prices.

- Development of novel payment agreements to assist with shorter-term budget concerns by payers may be necessary to reduce high upfront costs and also uncertainties over long-term clinical benefits of gene-therapies in particular in the real-world setting2.

- For example, Zolgensma has seen successful reimbursement in the US and German markets through outcomes-based rebates and instalment plans. On the contrary, Zynteglo (gene-therapy, $1.8m) had a value-based pricing agreement in place, but the company, Bluebird, chose to withdraw from the German market after failure to reach a pricing agreement. in the US it is marketed at WAC $2.8m alongside an outcomes-based reimbursement agreement3.

- The study highlights the difference in drug prices between Europe and the US. The Inflation Reduction Act (IRA), introduced in the US in August 2022, aims to make innovative medicines more affordable by providing greater negotiating power to Medicare and will require manufacturers to pay a rebate for drug list prices that exceed the rate of inflation2.

- Pricing reforms and novel payment models should be monitored to establish if they can address the challenges in the evaluation process and mitigate payer concerns through the collaborative sharing of risks and benefits to ensure patient access to innovative therapies.

- Limitations of this research should be noted: our analysis is based on publicly available pricing information and does not consider confidential discounts. Further, lifetime costs do not account for patients discontinuing treatment prior to death, or any survival benefits associated with the treatment if the analysis is based on historic life expectancy figures. The rare nature of these diseases also makes sourcing life expectancy data challenging.

Sources:

- How drug prices are negotiated in Germany. Commonwealth Fund. https://www.commonwealthfund.org/blog/2019/how-drug-prices-are-negotiated-germany Accessed 17/02

- Towse, A Pricing and Paring for Cures: Early experience with HTA of gene therapy in the USA. Office of Health Economics Review. February 2019;

- Explaining the prescription drug provisions in the inflation reduction act. KFF. https://www.kff.org/medicare/issue-brief/explaining-the-prescription-drug-provisions-in-the-inflation-reduction-act/#:~:text=The%20Inflation%20Reduction%20Act%20requires,inflation%20(CPI%2DU). Accessed 14/02

- https://www.lcp.uk.com/our-viewpoint/2022/10/zynteglo-highlights-stark-differences-between-eu-and-us-markets/ Accessed 09/02